March 16, 2022, 3:06 pm EDT

Market Cheers After the Rate Hike

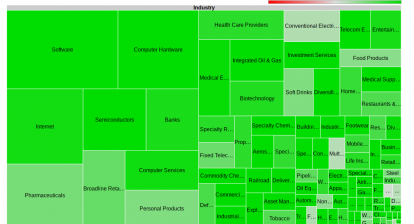

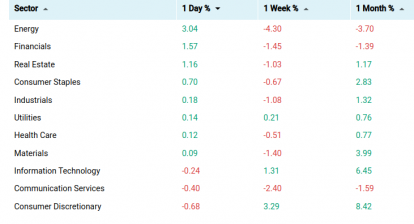

Fed raises 25 basis points or 0.25% for the Fed Fund dates from 0-0.25% to 0.25-0.5%. Also, there will be 6 more rate hikes in 2022 so the final rates will be around 1.75%-2% by the year-end. The stock market cheered about these actions by going up 335 points in DJIA. S&P advances +1.6% and Nasdaq is up about +3%.

Thus, we shall see interest rates begin to go up everywhere. Mortgage rates, credit cards, student loans, auto loans are going to climb uphill in 2022. Most likely, the rates could continue to go up in 2023 as well.

This is the second day of a rebound rally after Nasdaq briefly fell into a bear market or -20% from the top. Moreover, Chinese stocks rebound significantly after China government indicated its intention to help its falling businesses BABA +34%, JD +37%, BIDU +35%, SY +15%, NTES +26%.

Another viewpoint is from the positive expectation of the Russia-Ukraine war. Potential settlement and agreement smashed the energy prices and stocks. Defense stocks retreated as well because investors think the confrontation may finish soon.

Although market behaviors seem to point out a pretty picture about the rates and war, we are suspicious about it. It could be an oversold rebound in our opinion.

Technically, short-term bias, measured by 20 day-moving-average (DMA) lines, becomes bullish after two-day gains. Medium-term (50 DMA) and long-term (200 DMA) views remain bearish.

Our strategy is to wait for the next few days to determine the strength of the rebound in terms of the strength (volume pattern) and, breadth. Furthermore, we will check out any emerging leadership.

Overall, we stay bearish on the stock markets for medium and long terms.