March 17, 2022, 12:23 pm EDT

Opinions about global events, rates, COVID-19, and stock markets

This article is our opinions on global events, interest rates, COVID-19, and stock markets based on the latest development and our viewpoints. Although nobody knows the future, each trader and investor allocate their assets according to their viewpoints or analysis. If you are long-term investors who hold stocks for months or years, it is very important to understand the big picture and long-term effects such that daily noises will not confuse your decisions.

Global Events

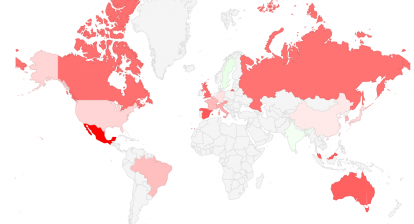

In our opinion, the Russia-Ukraine war is far from over. The appearance of ceasefire talk or agreement is a temporary tactic. There will be no winners in this war. The strong determination of Putin and weak responses from US-NATO simply make this war much worse and longer. Therefore, investing in commodities like energy (oil), basic material (aluminum, steel), agriculture (fertilizer) makes sense. In fact, the partnership between Russia and China becomes stronger than before. Because Russia needs resources to continue the war including weapons, equipment, or even soldiers. Currently, Russia is undergoing economic sanctions that desperately need another big country to help out. Once China is officially involved in providing military or economic support for Russia, we expect WW III is going to start.

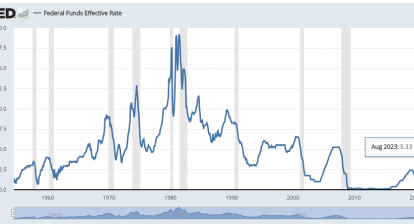

Interest Rates

Yesterday Federal Reserve announced the smallest increase of rates of 25 basis points to please the stock markets. It worked well for all major indexes. However, our view is that the excitement is going to be short. Out-of-control inflation is going to swallow any growth that the US can produce. As a matter of fact, the global economy is going to suffer much longer because of the record high prices of commodities. Therefore, we expect the housing markets and job markets are likely to crack and fall. Fed and US government created such a gigantic bubble. Payback time will be ugly.

COVID-19

US seems to get better at dealing with the COVID-19. But, we shall pay attention to other countries like South Korea, Germany, etc. Another way is to monitor the stock performances of Merdena (MRNA) and BioNTech (BNTX) who produce vaccines. These two stocks seem to build a base and prepare to rise up. If COVID-19 resurges in the US again after more openings in April, it could be another hit for the economy.

Stock Markets

Lastly, the stock market began its rebound after a 2-3 months drop since the beginning of 2022. It is still in bearish condition but it can get back to neutral if major indexes can recover their intermediate trend line or 50 day-moving-average lines. It is possible to happen. However, its long-term direction is tied to three factors mentioned earlier: wars, rates, COVID-19. Currently, they do not appear to be optimistic. The stock market is going to fluctuate up-and-down along with the news of the development. But, our viewpoint is bulls are over and bears take over the baton.

In summary, our portfolio reflects our viewpoints that are inflation-protected and defensive-oriented. At the same time, we keep monitoring any rising leaders that could provide investment opportunities for us to adjust our strategy.