December 3, 2021, 11:44 am EST

Breaking Down and Breaking Apart

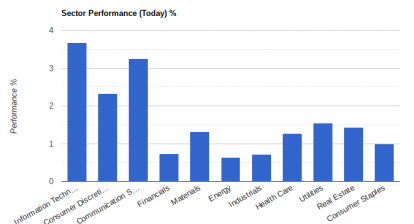

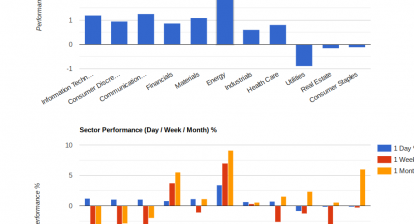

Yesterday’s rebound seemed to be ineffective to save the stock market. Today is the day of breaking down and breaking apart which reveals the loss of the leadership. Without upside leaders, the stock market is welcoming bears to arrive.

There are two groups of stocks we would like to address: High Flying COVD-19 and China Stocks. We will use two stocks DOCU and DIDI to illustrate our points.

High Flying COVD-19 Stocks

DocuSign (DOCU) is one of the strongest stocks from the beginning of the COVID-19, January 2020. DOCU rocketed from 80 to 240 in 2020 to take advantage of the lockdown or work-from-home that enabled documents to be signed electronically like home buying/selling and various legal documents. We also mentioned DOCU in our 01/12/2020 article.

But today DOCU drops -40% down after the company gave weak guidance. It is very unusual for any stock to drop this significant amount in one day. Thus, even the COVID-19 is still there or becoming more troubles, the good time for DOCU is over. Furthermore, we can see other similar examples going through the same process.

China Stocks

China Didi Global Inc (DIDI), which provided delivery service in China, was another example to show China’s bad times. Although DIDI was IPO and listed in the US stock markets in late June of 2021. DIDI reached a peak of 16.5 a few days after the IPO. But downtrend is immediately followed DIDI until 6.39 today. DIDI is about to delist from the US and may head to the Hong Kong market.

China experienced many troubles and crises in recent years. Its China Communist Party took many aggressive actions to drag down e-commerce giant Alibaba (BABA), REIT king Evergrande, the education system, and lots more toward Hong Kong and Taiwan. Even, it punished Australia economically when Australia asked China about the root of COVID-19.

China is the number 2 largest economic system in the world after the USA. Moreover, its fast-growing business in the past 10-20 years made many countries depend on its goods.

Well, a good time may be over for China as we mentioned in the 09/14/2021 article The Collapse of China Evergrande.

These two groups of stocks represent the strength of the stock markets for the past several years. However, they were beaten down badly both by investors and their businesses.

There are other examples for readers to check their performance:

- High Flying COVID-19: DOCU, ZM, PTON

- China: BABA, BIDU, PDD, EDU, DOYU, HUYA, GOTU, TME

In summary, the stock market is heading down since last week (S&P500, Nasdaq) or last month (Dow Jones) so it is still the early stage of the bearish markets. But, the breakdown of leaders is another evidence that the bulls are dying and bears are rising. We need to prepare for it.