April 18, 2022, 12:06 pm EDT

Bears Are Coming (QQQ)

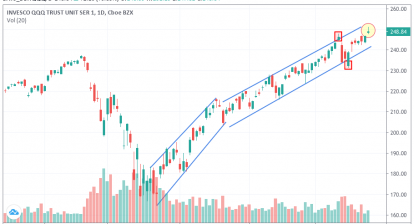

Definition of a bear market by widely accepted definition is -20% down from the recent high. Using this formula, we can see Nasdaq-100 (QQQ) could be a good example for us to track the status of the stock market as shown.

QQQ reached about 400 level in the beginning of 2022. Its -20% location is 320. Both levels are marked by dash lines on 01/01/222 and 03/14/2022, respectively.

After about a 2-week rebound wave during the 03/15 – 03/29, QQQ bounced on quickly to avoid getting into a bear market area. However, as we have seen in the last 2-to 3 weeks, QQQ wiped out most of the rebound power. Currently, QQQ is at 337 which is only a few percentages from the 320 key levels for the bear market.

Therefore, it is appropriate to say “Bears Are Coming” in our subject line. Please be aware of the fact that the second or the third tests of the key do not mean it will rebound as the first time. In fact, the probability of breakdown increases after the first rebound. Once it breaks through with a higher volume, 320 may flip to become a resistance line rather than the support line.

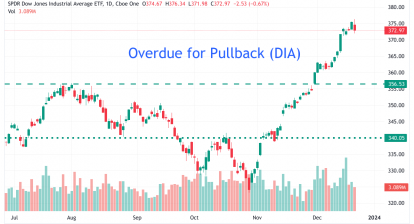

Thus, it should be a great warning message for market participants that bears are indeed coming. A much bigger sell-off, triggered by various events, will hit the financial markets in the next 1-2 years according to the past 100 years of historical data. If your investment experience is less than 13 years or after March 2009, you may not know what is the bear markets. You can use a stock chart to see the past bear markets in 2008, 2000, or even back to 1929 to get a feeling of the bear market.

This practice could get you ready for the coming bear markets. In our opinion, this bear market would be severe in terms of its intensity, and magnitude with lots of surprising events.