October 26, 2022, 12:13 pm EDT

Index Investor

The investment could be as easy as investing in one asset class. In the stock markets, a person could invest in one index only. The advantage of this strategy is simplicity. There is no need to study the earnings, news, and P/E for a company. There is no need to study the chart to identify patterns or use various indicators. All these data could be points of confusion rather than a clear answer.

Guessing this guessing that does not make sense if the overall performance cannot beat an index. In fact, a self-managed portfolio will likely lose an index performance.

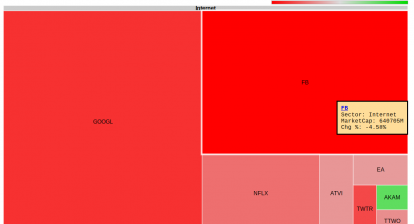

For example, the Nasdaq100 index (QQQ) rallied +235% (from 170 to 400) between April 2020 and December 2021 for the exact low and high of the bull market. How many people including professional fund managers can achieve this result or close enough for the optimal timing of entry and exit?

If you want to be an index investor, then you only need to answer two questions:

- Are we in a bull market or a bear market?

- Should I invest or keep cash?

Here is a way to answer the first question that is sensitive to timing so that a decision can be made fast enough to capture the maximal gains.

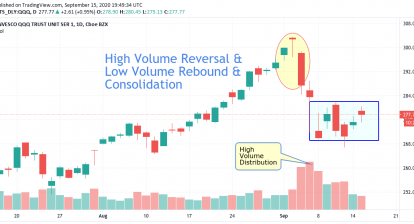

One simple way to tell a bull market or bear market is to check an index against its moving average lines for all trends (short, medium, long). Comparing whether a stock is above or below 20, 50, 200 day-moving-average lines will give a clear answer to distinguish bull and bear.

Applying this method to QQQ, you will see a bull market that started in April 2020 and ended in January 2022. So, it is possible to reach about +180% performance in less than two years.

The second question is relatively easy. In a bull market, you always want to fully invest in the market. In a bear market, you could consider keeping cash or not. Since a downtrend will dominate the entire bear market, it would be better to stay in cash in our opinion. Trying to guess the bottom is highly risky because no one knows where is the bottom in a real-time. There will be a bear market rebound or small rally but these could be traps rather than gains.

In summary, investing in an index could be a reasonable strategy for a long-term investor. In most cases, the performance could beat most traders, investors, or fund managers with a simple method.