May 3, 2022, 12:31 pm EDT

Bear Market Behaviors

Do not be confused with a sudden rise in a stock or index during a bear market. As it happened yesterday and this morning that many beaten-down stocks rebound from the bottom. This is a typical behavior after oversold conditions with a reasonable rebound. The difference between an opversold rebound and a bottom reversal is whether they can make a continuous rally for weeks and months. We can monitor the results to justify our observation. In our opinion, the current rebound is simply a bear market behavior.

We can use the following criteria to determine if the market is in a bull or bear cycle:

Economy:

- Inflation is back to the normal range of 2% for both the Consumer Price Index and Producer Price Index

- The federal fund rate stabilized. We are at the beginning of the rising cycles as we will see another at least 50 basis hike tomorrow.

Fundamental:

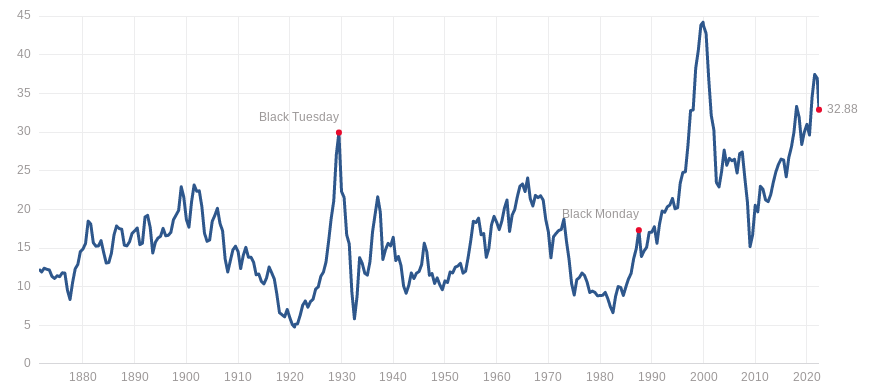

- Shiller P/E ratio back to 10-15 range. The current level is 33. It means that the valuation of the S&P 500 is way too high.

Technical:

- All major indexes, Dow Jones, S& 500, and Nasdaq back above their moving average lines (20,50,200).

Excess liquidity created by the US, Euro, and around the globe in the past several years needs to be digested for the next one or two years in order to bring back the normalcy of the market conditions. Meantime, you would likely be a winner if you do not lose money by staying mostly in cash positions.