June 1, 2022, 9:26 pm EDT

Quantitative Tightening

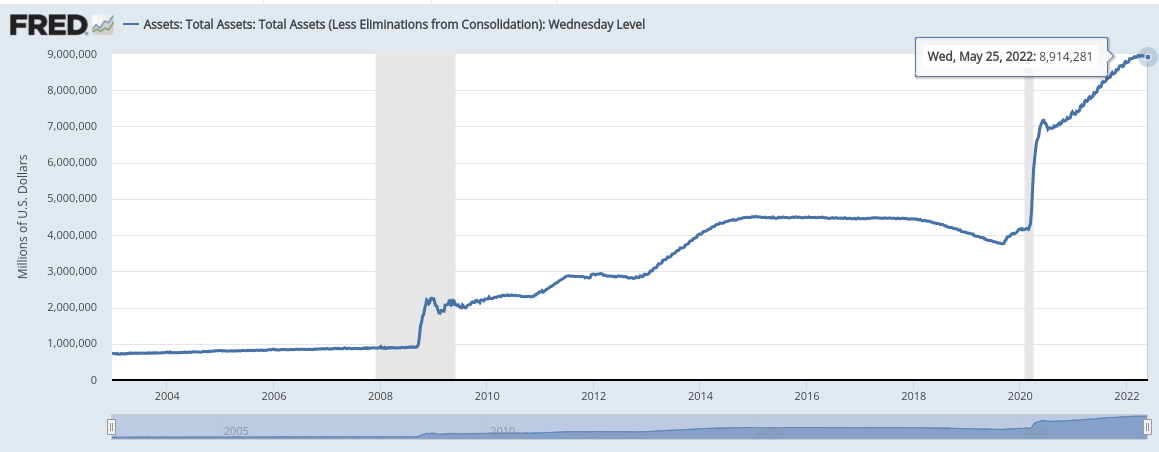

Quantitative easing is to print money. Quantitative tightening is the reverse process of taking back money from the Fed. More liquidity boosts the stock market prices directly as shown. Obviously, 2009 marked the beginning of this 13-year-old bull where the Fed’s balance increased from $1 trillion to $2 trillion. The other big jump was the past two years 2020-2022 when the balance sheet inflated from $4 trillion to $9 trillion. If we compare the Fed balance sheet with the stock market, it should be easy to see the correlation between them.

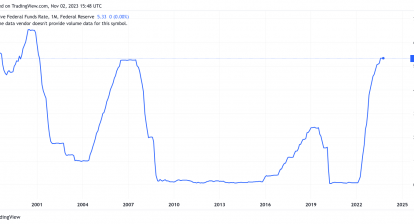

Starting today 06/01/2022, the Fed will begin reducing its holdings of Treasury securities, agency debt, and agency mortgage-backed securities by a combined $47.5 billion per month for the first three months (June – August). After this, the total amount to be reduced goes up to $95 billion a month from September 2022.

The drawback of unlimited quantitative easing is the explosive inflation that exceeds the 40 years of history. From the record high of the stock markets and housing markets to gasoline and food, it makes people’s life tougher, not better.

Therefore the reversal process starts today called quantitative tightening.

Combining with higher Fed fund rates, the stock market and housing markets should cool down significantly in the next 1-2 years.

This is the main reason we do not think any rebound will carry to a significant rally in the stock markets as long as the tightening process continues.