August 11, 2022, 12:34 am EDT

Improved Inflation Data

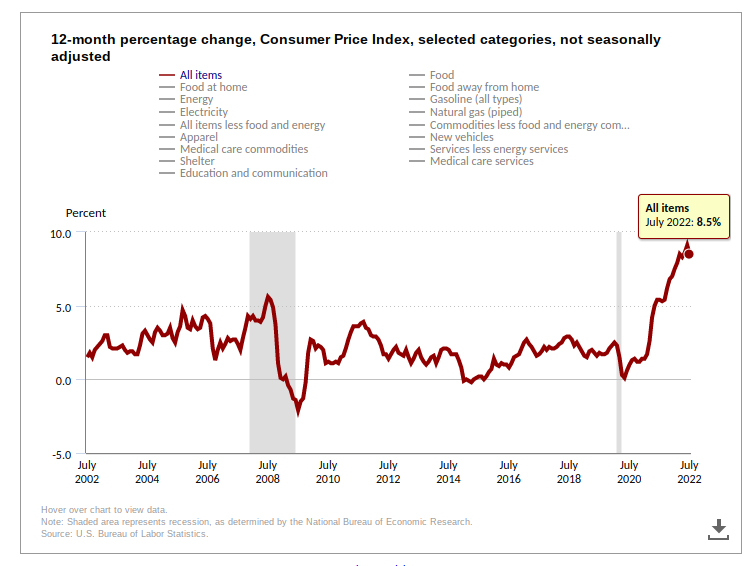

July Consumer Price Index (CPI) reduced to 8.5% where it was off from the peak of 9.1%. The stock market cheered with DJIA +1.45%, S&P 500 +1.7%, Nasdaq +2.89%.

Indeed, the inflation threat is slightly lower. But, does it mean that economy begin to slow down? In other words, cooling down from the red hot inflation is expected if the pace is under the acceptable range such that the recession is at a shallow level.

Crude oil prices also drop to the 87-92 range which echoes the decline of the CPI.

Although the direction of inflation seems to improve, geopolitical uncertainty between Russia-Ukraine, US-China, and Israel-Palestine is on the rise. Escalation of any military confrontation could quickly stir up inflation again. Thus, we should watch out for these regions carefully.

Overall, improved inflation data is encouraging for the US economy if the economic slowdown is at a smooth pace. Also, we would need to pay attention to the development of wars.