April 12, 2022, 11:24 am EDT

Face Value vs Future Value

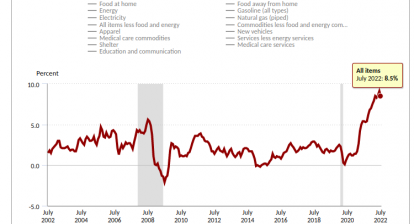

Do you read the face value or guess the future value when knowing economic data? For example, Consumer Price Index rose 8.5% in March and hit another 41-year high record high. Is this bad news or good news for investment?

This could be bad news because high inflation would choke the economy. Consumers would scale back spending due to the extra cost of energy, food, and everything. Companies would cut back on hiring or even close business because of a lack of profits from the rising cost of materials and fewer customers. Face value means bad news is indeed bad news.

The other group of people thinks high CPI could be good news because the worst is over since the chance to get worse is much lower. Thus, the markets could turn around. Thus, it is a good time to buy the dips because the future will be better. They take the future value of current data.

Which side would you take?

Although investment involves guessing the future, we like to take face value for the data. The reason is that nobody knows the future. Whether it is the bottom or top or anything in between is always unknown to everyone. We believe that it is essential to realize the importance of the present and prepare for the future. When the turning point arrives, there will be enough evidence for us to digest and change our investment strategy accordingly. Guessing the future either taking an optimistic view or a pessimistic view is not reliable. We simply need to stay humble and acknowledge the face value or present status.

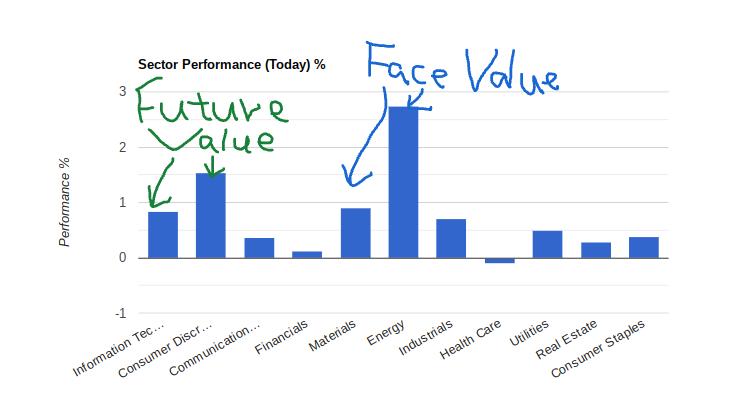

Currently, the stock markets seem to take the future value from the CPI 8.5% data by rising nearly +200 points in Dow Jones, +0.6% in S&P 500, and +0.9% in Nasdaq. However, looking closer for details we found out that they are many stocks that take the Face Value of the CPI. For instance, the face value picks energy and material sectors whereas future values like technology and cyclical as shown.

By taking the face value of high CPI or recognizing the inflation era, we added more positions on energy (oil) and material (precious metal).