May 4, 2023, 1:01 pm EDT

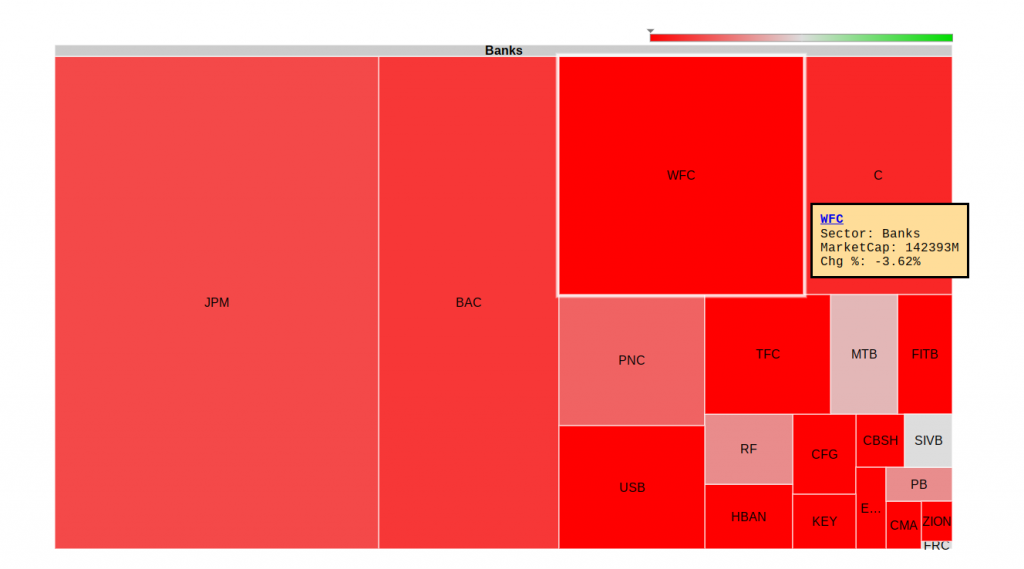

Banks New Low

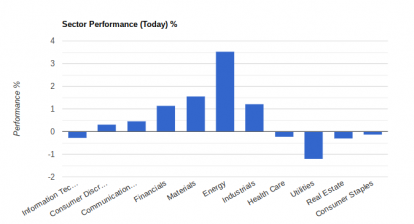

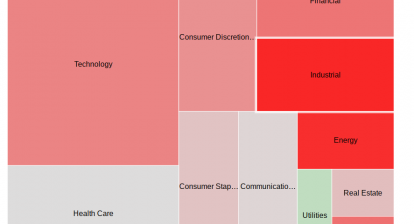

After Fed Chairman Jerome Powell’s statement yesterday, banks tanked again. Technically, money center banks (C, BAC, WFC) were near their low points about a month ago.

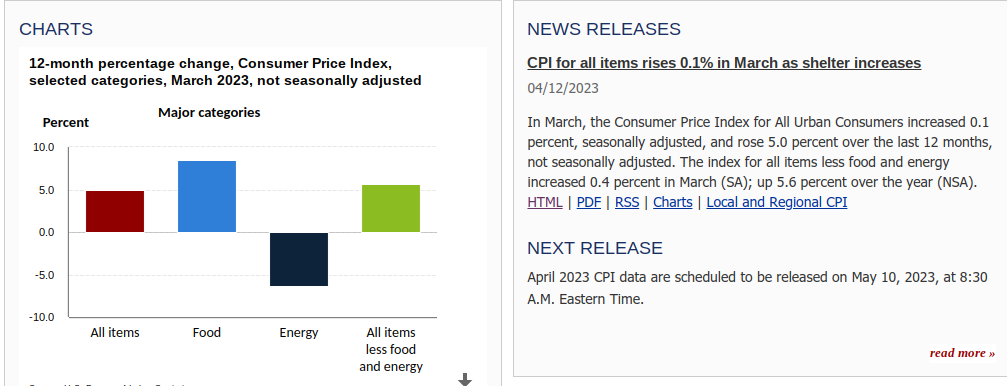

Although Fed may pause the rate hiking process after reaching the 5.00% – 5.25% level, we believe the process is far from over according to its pre-set target of 2% for inflation. CPI is still at 5% (US Bureau of Labor Statistics)

Our interpretation of the Fed’s intention is that inflation requires a lengthy rate-hike process to deal with it.

Regional banks suffered badly as they collapsed one after the other (Signature Bank, Silicon Valley Bank, First Republic Bank). A negative yield curve has been there since 2022 (09/21/2022 A Negative Yield Curve Means A Big Trouble) as mentioned.

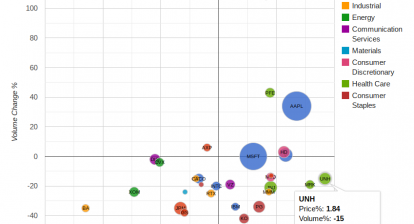

In the meantime, precious metals like gold miners (GDX) and gold shares (GLD) continue their new high journey.

It is possible that the stock market will need to go through a tough cycle when banks dig their basements.