April 16, 2024, 2:45 pm EDT

Breakdown and Follow-Through

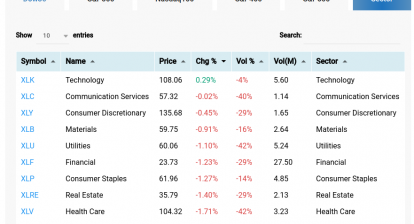

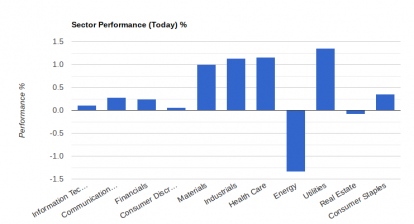

The stock market had a hard time recovering from the beginning of April. All major indexes, Dow Jones, S&P 500, Nasdaq, lost their technical 50 day-moving-average line, which is a key level for medium trend. Moreover, the breakdown yesterday for S&P 500 and Nasdaq is the follow-through for Dow Jones on the downside action which carried on for more than two weeks already.

The trouble is obvious. Geopolitical speaking, Iran attacked Israel with hundreds of drones and missiles during the weekend that is fatal for a peaceful outlook in the Middle East region. Everyone is watching Israel on its counter-attack which could happen soon.

Economically, the impact of the slowing economy in China is surface to US companies. For example, Apple (AAPL) and Tesla (TSLA) stock performance reflected their struggle on disappointing sales for 2024. One main reason is the weak buying power from Chinese consumers. Tesla (TSLA) also announced the 10% layoff yesterday in order to save their spending for the coming quarters that would be ugly in the earnings report.

The US Fed seemed in trouble to explain why their strategy and policy for improving inflation does not work. In fact, the Fed may need to announce officially that their initial goal to cut the rates 3 times in 2024 may not be fulfilled. The higher rate would hammer interest-sensitive industries like REIT, Home builders, and consumer-related products and services. We can easily see the home builder ETF (XHB) ended the rally from November 2023 to March 2024 as shown.

Unstable geo-political environment, wars, and inflation pressure become a boosting power for the US dollar. Its upside momentum can be seen from the ETF (UUP).

In summary, the investment environment becomes muddy or cloudy. Raising a higher cash level or staying conservative in money management could be a reasonable choice.