January 2, 2024, 11:05 am EST

Happy New Year

Happy New Year to all of you for the first trading day of 2024.

The pullback was overdue after the strong finish of 2023. Nasdaq gave up more portions as it also ran the strongest among major indexes in 2023. So, it is expected without surprise.

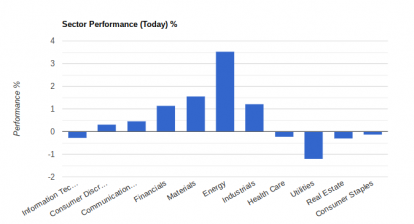

However, it is important to notice the rotation into the strength of the Healthcare sector. Its ETF (XLV) is up +1.6% as of now. Compared to the Nasdaq-100 ETF (QQQ) down -1.6%, money managers prepared their portfolio to welcome 2024.

Literally, it spells out defensive tone when drugs and pharmaceuticals are in the lead: MRNA +13%, PFE +4%, AMGN +4%, BMY +3%, INCY +3%, MRK +3%, GILD +3%, REGN +3%.

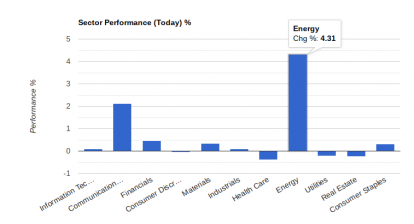

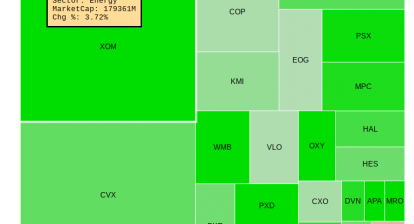

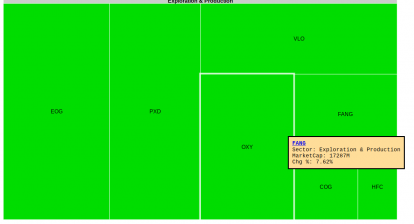

Another important sector to watch would be the energy sector where its ETF (XLE) is up about +1.2%. More troubles in the red sea as an Iranian battleship got into and the US set it up to ready-to-fight position. Needless to say, not only the oil price is likely to go up, but also inflation may be back again when goods are unable to go through this region safely

The potential rise of crude oil price and inflation are fatal to the global economy for sure. It would be a puzzle to wonder why the stock markets decide to ignore it in 2023. One thing we can assure is that the inflation will heat up again when the crude oil price comes back to $90 level.

Geopolitical conflicts may become a major theme in 2024. In our opinion, the long term view of the stock markets is bearish. If another major war began to trigger, the collapse of the stock markets could respond to it. It does not matter the locations: Middle-East, South China Sea, Taiwan strait, North-South Korea or spreading out of Russia-Ukraine to further into the European region.

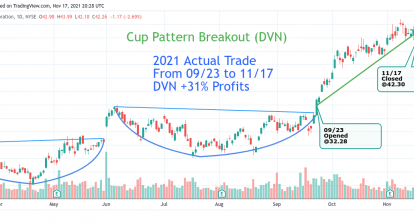

Both Healthcare and Energy sectors could offer investment opportunities for the reasons stated above. But, overall investment strategy should gear toward defense.