June 29, 2020, 3:19 pm EDT

High Price Low Volume Rebound

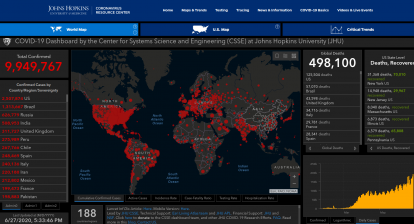

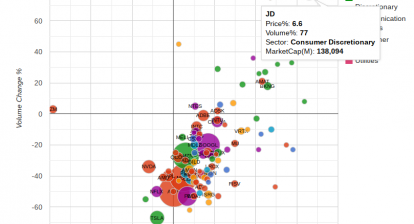

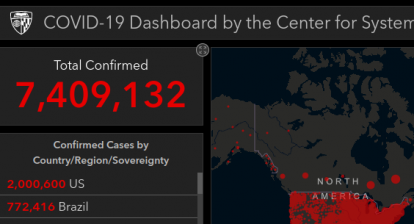

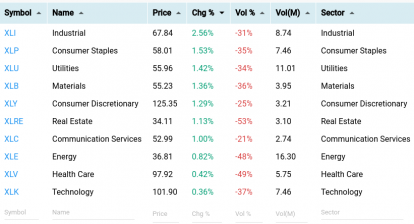

High price (DJIA +400 points) move and low volume behavior (< 30-50% as shown) could confuse market participants on what markets intend to do after last Friday’s -700 drop corresponding to record high number of COVID-19 affected numbers for US and worldwide.

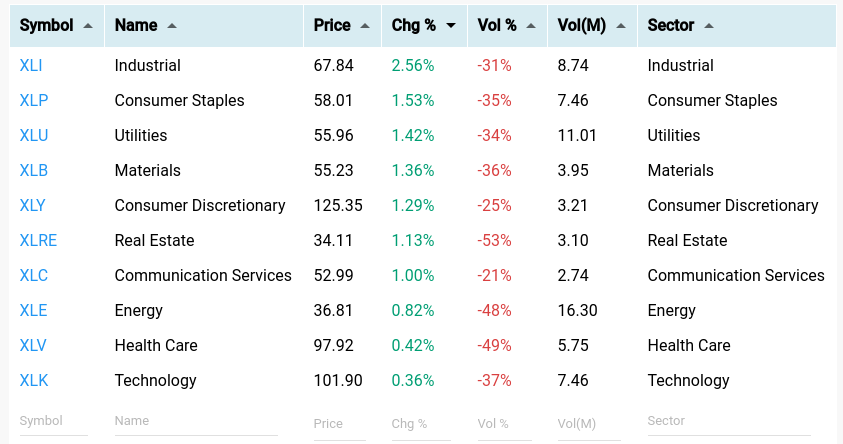

Besides volume is lower than average, look closer for stock leaders. We find out industrial (XLI +2.7%) distorted DJIA significantly. Especially, BA +13% boosted DJIA much higher gain compared to S&P and Nasdsq.

Airliners LUV +9%, AAL +7%) and consumer discretionary (COTY +12%, KSS +9%, PVH +8, RCL +7%, NCLH +7%) also paint a bullish picture.

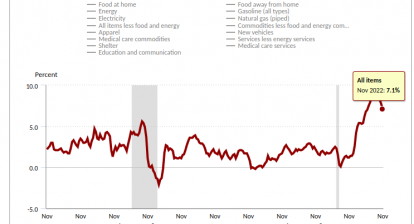

The main question to ask is that can the economy keep going strong when COVID-19 gets worse ? Or, maybe the virus will fade away quickly, or treatment and vaccines will defeat the virus altogether ? This goes beyond what we can see the situation now but this might be what drives up stock markets again.

In summary, we want to see higher volume and broader leadership to convince stock markets can