December 27, 2020, 6:14 pm EST

2020 Review

2020 is near the end. It is time to review what happened in 2020 in order to prepare for 2021 in terms of investment idea and trading strategy.

Everyone would agree that 2020 is a very special year that nobody expected before. Worldwide COVID-19 virus that killed 1.7 million globally and 330K in the US (as of 12/27/2020). Unsettled US presidential elections are another highlight that consisted of numerous fraudulent cases and drama before the after elections. Lastly, trade disputes between US-China, China-Australia and military tensions in the South China Sea, Taiwan added a lot more political complexity with HongKong.

Based on the above major events, vaccines are quickly developed to fight with COVID-19. Series money printing policies like stimulus plans stirred up stock markets with fresh US dollars. New technologies emerge quickly to adapt to the new lifestyle of working-from-home or stay-home practice. Crisis brings both tragedies and opportunities. If we understand how the stock market operates, then major changes could be the source of profitable trades. In this article, we will outline how we captured these changes and made profitable trades.

Based on COVD-19 and political events, we categorized our profitable trades in five sectors: healthcare, technology, consumer discretionary, industrial and material.

Healthcare

When the disaster of COVID-19 cases exploded in February, it slashed major indexes about -40% from its high (Ex: DIA from 302 to 183) between February and March. It should be easy to figure out who would become winners of this event. Bio-tech, pharmaceuticals and medical equipment providers were the fast runners when masks, drugs, and equipment were in high demand. People were anxious to know who can make vaccines to deal with this unknown disease. Thus, here are the winners of our trades.

Technology

Working from home order brought up new technology like Zoom (ZM). IT support became essential to support numerous applications for small business. So, Upwork (UPWK) and Slack Technologies (WORK) stood up quickly. Election fraud gave FireEye (FEYE) a chance to prove its software is able to discover the problem.

Consumer Discretionary

When online shopping is the only choice, we noticed Chewy (CHWY) online pet stores might be a winner. If online learning becomes a must, then online textbook provider Chegg (CHGG) should be in high demand. Where people can work out when all gyms are closed ? Peloton Interactive (PTON), indoor cycling may be a good choice. How about ordering food online ? Who will deliver the food for you ? Grubhub (GRUB) is there for this purpose. Want to save money because of losing jobs ? How about shop some items from Dollar General (DG) ? Lastly, the US suffered COVID-19 badly. But the other side of the world like India and China were doing just fine. In fact, some businesses grow fast like MakeMyTrip (MMYT) and BiliBili (BILI).

Industrial

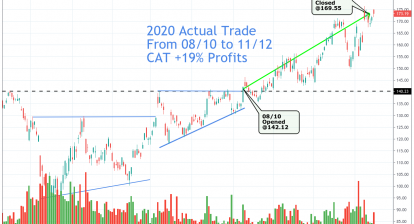

Stimulus is to help business to survive. Thus, airline maker Boeing (BA) and Ford (F) rose up quickly wherever there was a hope for economic recovery. Equipment makers Caterpillar (CAT) and Terex (TEX) are necessary tools for infrastructure and home building. Home builder Pulte Group (PHM) and other home builders were doing great because of super low interest rate policy.

Material

Lastly, global money printing caused the US dollar to plunge significantly (Ex: UUP top 29.89 in March and hit 24.20 in December). In addition, China-Australia trade wars gave iron-ore a short supply. This is a very unusual 30% jump in commodity prices in a month like iron. Other materials show similar strong performance.

Although there are many trading strategies and methods to get profits, we illustrated our methodology to get 15-30% profits in a few weeks or few months as shown. Sometimes, we can get a fast 40% or even 100% if timing works out perfectly.

We will publish our next article for our Gold member: “2021 Outlook” before the new year.