September 17, 2021, 6:27 pm EDT

High Volume Turnover on Mega Technology

Volume matters. When the trading volume of a stock is far above the average volume above 50% or 100%, it means that a large crowd or institutional investors took action on this stock. If the closing price is up, it represents aggressive accumulation. When the closed price is down with a high volume, it shows distribution behavior.

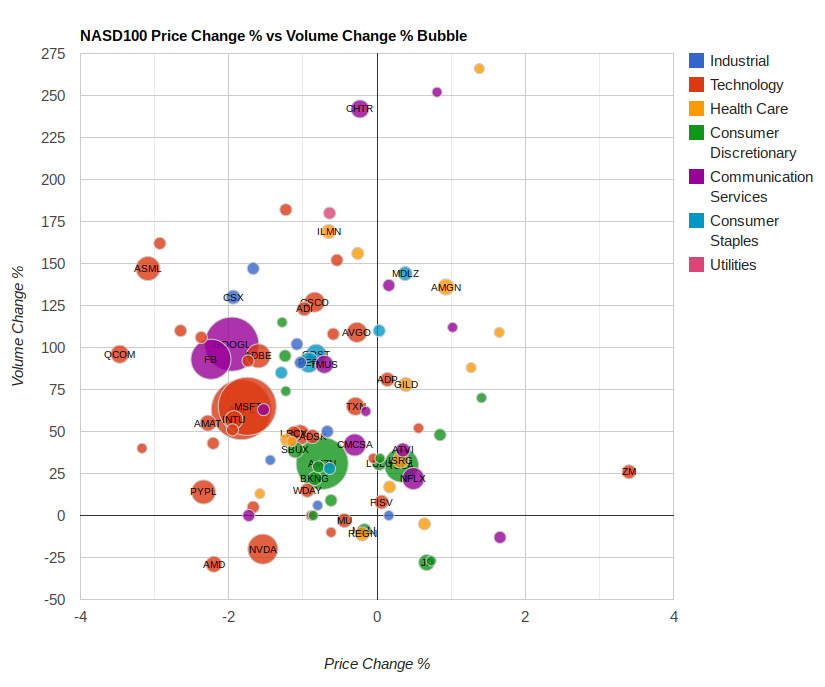

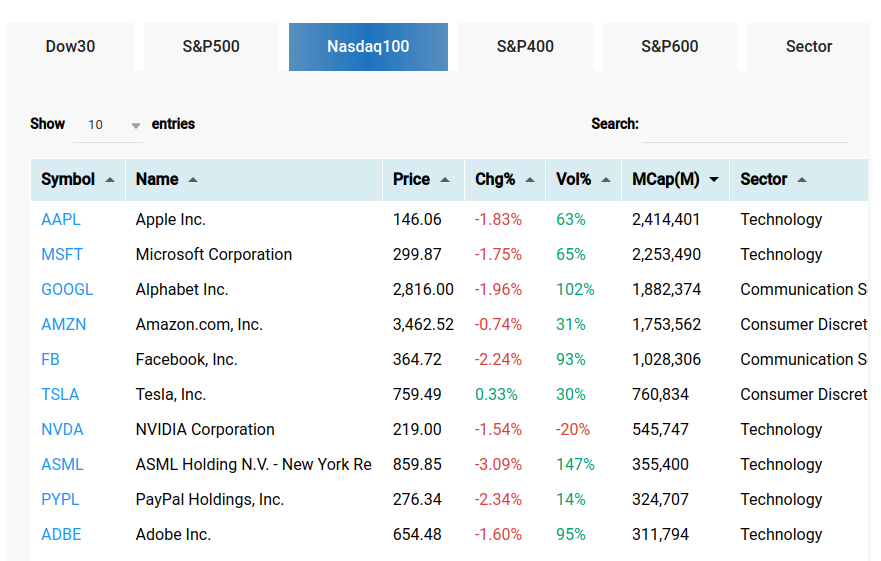

Looking at the featured bubble chart for the Nasdaq100 or 100 the largest company traded in the Nasdaq market, we can see there were many stocks located at the upper-left quadrant. It shows most of the Nasdaq 100 stocks were in high volume trade (mostly 25%-200%) with about 0-4% down for the price action. Especially, please note that the big 5 mega technology stocks were all there:

AAPL, MSFT, GOOGL, AMZN, FB.

Traders and investors use their actions to tell us what they were thinking about the future of the stock markets. Everyone knows it is extremely to protect the profits or reduce exposure if the outlook is not so bright.

At this moment, the Nasdaq index is still near the record high zone so it still looks very bullish. But, high volume turnover gave us another look to be cautious at an early stage.