November 3, 2021, 9:08 pm EDT

All-time high again

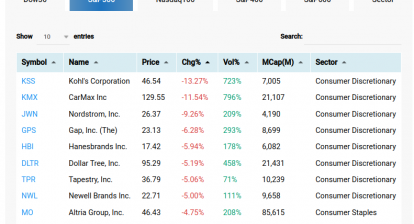

Today was another all-time high for all major indexes. Nasdaq-100 (ETF: QQQ) already made near +12% in a month (350-393) as shown. Consumer discretionary scored +1.8% gains to occupy the leading sector spot.

Fed chairman also announced the tapering bond purchase program in late November. It would reduce $10 billion in Treasurys and $5 billion in mortgage-backed securities. Thus, interest rates are going to rise for the months and years to come. The impact on inflation could be more severe. Therefore, we think the consumer would also tighten up their pockets to constraint their shopping. Material and energy may have another leg up opportunity.

Overall, the stock markets are still in the super bullish mode so the portfolio should be in fully invested mode. However, market breadth readings are less desirable. It means stock picking becomes harder. Focus on the fresh breakout and red-hot sectors and industries are the way to go.