August 19, 2022, 4:13 pm EDT

Stay Defense and Defensive

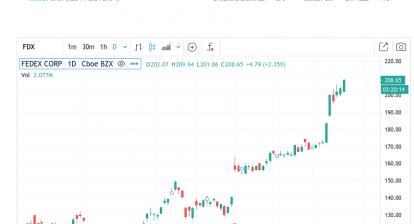

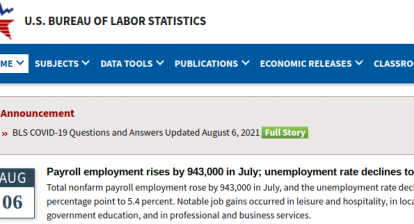

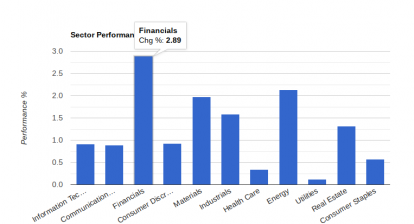

The stock market has been strong during its rebound wave since June 20, 2022, for the past two months. This rebound effort carried about 20% gains for Nasdaq and S&P 500. However, the rebound hit the long-term line, its 200 day-moving-average, as mentioned in the previous 08/17 article. We will use SPY 408 as a reference to determine if bulls can stop bleeding.

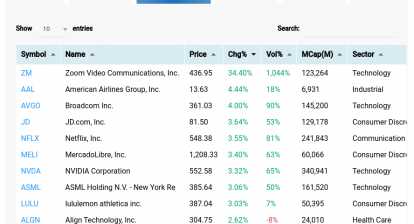

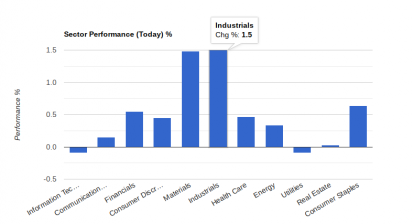

‘Stay Defense and Defensive’ could be a reasonable strategy in this type of market. Here, defense means defense industry. Defensive sectors include the following sectors: consumer staples, healthcare, REIT, and utilities.

- Defense: NOC, HII, GD

- Consumer Staples: CPB, K, HSY

- Healthcare: HUM, CI

- REIT: WPC

- Utility: AEE, DUK, WEC, CNP

Please check out these charts and you will see how investors allocate their money on them in expecting a return for the tought time ahead.