November 16, 2021, 12:51 pm EST

Consumer Power

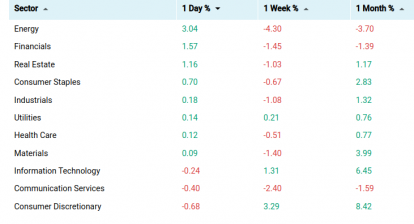

The stock markets show that investors bet on consumer power in cyclical items regardless the inflation. It may not be true for the long term but this is how the markets reveal today.

Homebuilder suppliers in Home Depot (HD) +6% and Lowes (LOW) +4% both gap up today in expecting the need for home improvement. At the same time, home builders keep strong upside momentum as shown on the ETF (XHB) +2% for making new highs since the beginning of November.

It contradicts the thought that a higher interest environment would have a negative impact on home builders. Thus, it is questionable that home builders or home improvement stocks can run higher when Fed decides to raise the rates.

On the other side of consumer areas, Nike (NKE) +2% represents much broader consumers who simply want to upgrade their gears for the holidays. Especially, economic re-opening after strict COVID-19 limitations gives people a strong reason to go out and explore around.

Therefore, we can see consumer discretionary is the strongest sector today (XLY) +1.6%.

However, it is also important to remember that COVID-19 is not over yet and the worldwide economy is still relatively weak. Thus, staying cautious and sensitive for investment decisions is essential behind the bullish bias.