December 10, 2021, 11:18 am EST

Near 40 Years High Inflation

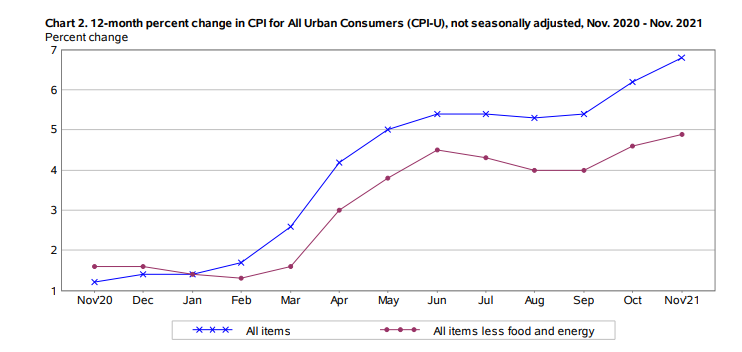

The November inflation data or Consumer Price Index reached 6.8% that surpassing another record near 40 years of history (1982). These numbers are made through the most shutdown period of 2020-2021 due to COVID-19. It means that this inflation is not the result of a high growth economy. Rather, it is a direct outcome of overflowing liquidity. The US printed trillions of dollars in order to deal with the economic slowdown. Furthermore, it stirred up the record-high stock markets.

However, the pain is going to intensify getting into 2022 on hyperinflation or monetary inflation occurring at a very high rate.

Thus, the big picture looking forward to 2022 will be on rising rates environment led by Fed. Although high growth or high borrowing stocks may suffer, some dividend-paid stocks may take advantage.

In general, it would be appropriate to add portfolio positions for the sectors in utility, consumer staples, REIT and healthcare for defensive actions. We can also monitor the performance of these sectors to see if they outperform others for the days to come.

In summary, hyperinflation will hit business activities because people began to tight up belts on spending. Thus, investment strategy should be geared toward the defensive type accordingly.