July 13, 2022, 7:48 pm EDT

What’s Next After Red Hot Inflation

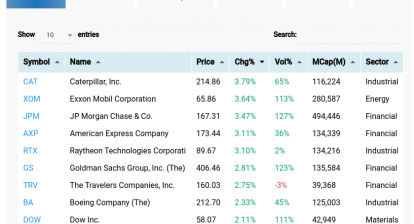

June Consumer Price Index (CPI) came out today with 9.1% and core CPI 5.9% which were both higher than expected at 8.8% and 5.7%. The stock markets reacted mildly down: DJIA -0.67%, S&P 500 -0.45%, Nasdaq -0.15%.

But, this is not a small thing to see CPI reach 41 years high since 1980. Both individuals and businesses struggle to meet their needs in an inflation environment. Also, there is no guarantee that this is the peak of inflation. Even though oil prices came down recently, there should be a long way to slow down inflation down to a 2-3% level. Here are things that are almost guaranteed to happen next:

- Fed rates hike: 0.75% in July could be the case

- The slowdown in the housing market due to the higher rates

- The slowdown in earnings: banking, consumer goods, technology, industrial

- The slowdown in job markets: hiring freeze, layoffs

- Risky asset class bubble bursting: cryptocurrency, no-earning companies

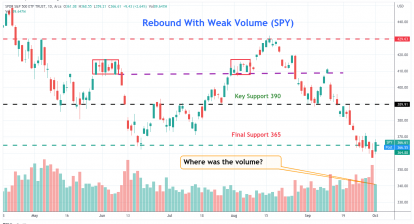

Earnings season should reveal all the points above in the next 3-4 weeks. We believe the stock markets will go through high volatility and new lows in response.

In summary, the downside potential is much larger than the upside chances. So, please be prepared.