January 24, 2022, 4:38 pm EST

Bull-Bear Transition Series 3 – Charting Perspectives

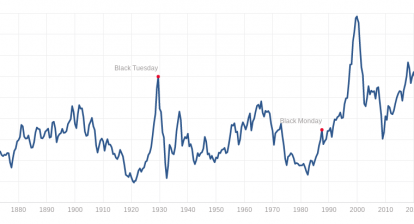

There is no specific and universal metric used to identify a bull market. Nonetheless, the most common definition of a bull market is a situation in which stock prices rise by 20% from the most recent bottom. We can apply the same principle to define a bear market which means falling -20% from the recent top.

200 Day-Moving-Average Line

We would like to use another way to characterize a bull or bear market according to a technical indicator, called 200 day-moving-average or 200 DMA. If the market is above its 200 DMA line, it is a bull market. If it falls below its 200 DMA, we called a bear market. The advantage of using this definition is that it may provide an earlier signal. It may not work for all markets but it could work in general.

For example, check out the featured chart for the previous bear between 2007-2009 with the red line for the 200 DMA. We can see it marked DIA about 134 on 12/28/2007 as the beginning point for the bear. Then it finished on 07/15/2009 at 84. The lowest point is about 66. So the drop was about -50%. In this example, we can see clearly that the 200 DMA captured the entire bear market properly.

Please see the above chart for the last year 2020 COVID-19 bear where DJIA lost about -38% but it recovered quickly. By using the 200 DMA method, it does not produce a meaningful result (beginning and ending almost at the same level) because market conditions changed too fast in this scenario.

In general, the average bull market is about 5 years and a bear market is 2 years in length. 200 DMA is about 40 trading weeks so it should be applicable for most market conditions even it did not work for 2020.

Now, we can apply it to today’s market. Even though the stock market turned -1000 points in DJIA today at closing, it is still below its 200 DMA. Therefore, the bear market tag still applies. In fact, S&P 500 and Nasdaq are also under the 200 DMA so the entire markets are still in bearish mode.

Once we identify the market condition, either bull or bear, then we can use various investment strategies accordingly.