February 20, 2022, 6:29 pm EST

Bear Market Strategy

There are ways to keep and make money in investment during a bear market if the strategy is applied correctly. Although it is harder to stay in the green during the bear market, there are some principles and practices that are worthy of attention for traders and investors to apply in the next 1-2 years’ markets.

Do not

- Do not try to predict or guess the bottom by rushing in to buy the dips. You will be wrong most of the time. Simply wait for the market to show you that it gets back to all moving average lines (20, 50, 200 day-moving-average lines)

- Do not hold or buy losers that are down -30% or more in a few weeks/months as we mentioned in the previous article. They could go down another -30%, -50%, or even -70% from the day you buy.

- Do not buy a stock that cannot make money now. Any promising future is simply a dream. During the tightening period, borrowing money is hard and expensive. The unprofitable company could go belly up or bankrupt at any moment.

Do

- Do make sure your portfolio is healthy. If you do not know what to buy, holding cash is definitely fine. In fact, you will have peace of mind and nice sleep when others suffer badly during the bear market.

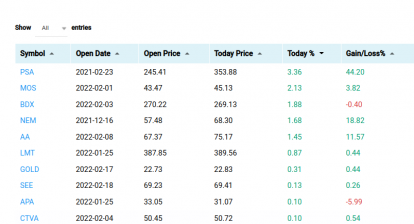

- Do consider buying a stock that pays a dividend or fixed-income funds.

- Do buy and hold solid defensive stocks in consumer staples, utility, or healthcare sectors.

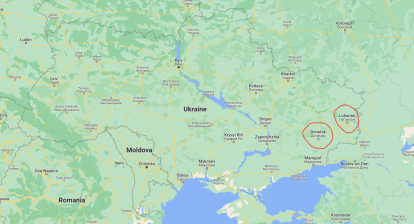

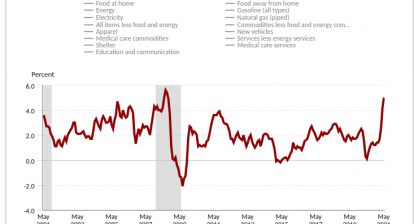

- Do watch and buy special event-driven stocks. For example, consider defense stocks when warfare starts or commodity stocks during inflation. Usually, a bear market will come with tragedies that bring some opportunities.

A bear market does not mean you need to lose money or have nothing to do with investment. In fact, it could offer a wonderful time for investment. For instance, we need to wait 12 years since March 2009 for this moment to come. Usually, a bear market lasts a one-and-half years to two years in duration. Therefore, it is a rare opportunity for us to take advantage of it.

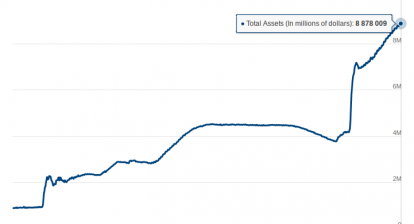

We saw many signs last year that bulls were near exhaustion in 2021. Especially, last November Nasdaq made a final top. Furthermore, Dow Jones and S&P 500 reached the final top at the beginning of 2022. We published many articles to describe the bull-bear transitions from the economic, technical, and earning points of view. Please check out our past articles for details.

Our next article will get into details about the sectors, industries, and individual stocks for “Bear Market Investment”.