March 10, 2022, 11:17 am EST

Inflation Era

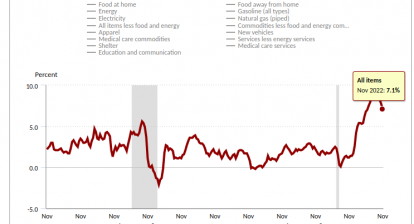

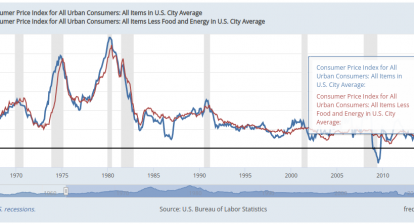

It should not be a surprise to see high inflation data this morning of the Consumer Price Index (CPI) reaching another 40-years high record of 7.9%. Because everyone already knew the skyrocketing prices of gasoline when pumping your vehicles at a gas station.

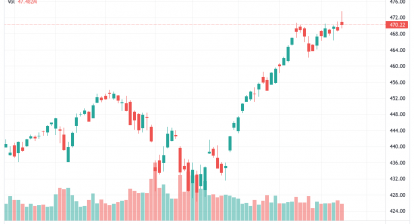

Even we knew the number is not pretty, the stock market still reacts in a bearish way that drop -370 points in Dow Jones and lost -2% in the Nasdaq index. There is no doubt about it that the war and sanctions made the trouble much bigger and deeper. Especially, there is no sign that the war is going to finish soon.

In fact, China keeps exercising its military power toward Taiwan. It could be a sign that another battle may start in Asia. There are similarities between Russia and China where both countries are dictatorship political systems. Also, their domestic economies are in a bad shape. Thus, attacking a neighboring country serves multiple purposes of getting resources and distracting attention. If China starts its war, then it is not hard to imagine what will be inflation looks like.

Inflation-friendly portfolio and strategy should be noted for the coming months or years. Commodities in basic material, agriculture, precious metal, energy are necessary to stay in the green color during the inflation era. Furthermore, food, defense, and fixed-income (REIT, high-dividend) stocks are helpful. Lastly, avoiding buying the dips is one of the best actions to do because nobody knows the bottom until it happens. There is no need to become a genius in investment.

Stay humble and understand reality is good enough to go through the inflation and bear market.