April 28, 2022, 11:06 am EDT

Recognizing and Following Trends

Sometimes, the important thing is easy to remember but hard to follow. For example, if you need to find food or water to survive in the forest, then following a flat or downhill path has a better chance than an uphill because it can save you energy. Recognizing and following trends in the stock market applies the same principle.

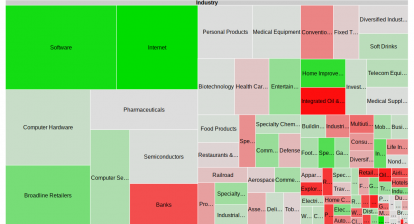

Individual investors can never change the trend of the markets. Even Meta Platforms Inc (FB) +11% made a strong earning report last night cannot change the trend of the market which is going to the downside.

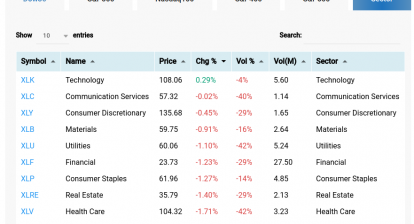

We may ask “how to recognize the trend of the markets?”. Our method is to use moving average lines: 20, 50, and 200 that apply to short-term, medium-term, and long-term trends. We can see clearly that all major indexes (DJIA, S&P 500, and Nasdaq) are under all these lines this week. Thus, there is no doubt that markets carried a heavy burden to go on the downtrend.

Excess valuation is caused by printing money, spending money, and borrowing money from the government. It brings in inflation, rising rates, and balance sheet reduction. Once the trend is formed it keeps going for a while until all factors are consumed.

Thus, our gear is switched toward bear market mode which means a defensive style in stock picking and trading activities. If the market condition changes, we will pick up the offensive equipment again.