May 17, 2022, 10:42 am EDT

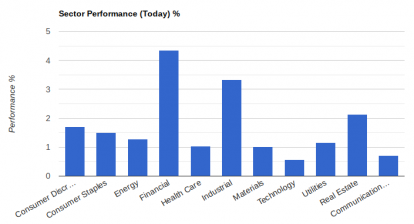

Dead Cat Bounce

The best phrase to describe today’s opening with +300 points gains in Dow Jones is “Dead Cat Bounce”. Here is the Wikipedia definition:

In finance, a dead cat bounce is a small, brief recovery in the price of a declining stock. Derived from the idea that “even a dead cat will bounce if it falls from a great height”, – Wikipedia

How to distinguish between a bullish breakout or a dead cat bounce from a 300 points opening? Simply looking into the leader stocks with respect to their relative positions for the past 12 months. Are they near their 52-week highs or 52-week-low? If they are making a 52-week high, then it is a bullish breakout. If they are up from their recent low regions, then it is called dead cat bounce.

Now, please check out the following top-5 Dow Jones leaders: JPM, CSCO, INTC, CAT, GS. Their trends are all down prior to today’s gains.

You can apply the same principle to the Nasdaq and S&P 500 to justify the quality of a bing intra-day gains.

The danger of dead cat bounce is that it fools traders and investors to jump in the markets because they thought there is a bargain.

Yes. there could be a bargain today but they are more bargains weeks or months later.