June 13, 2022, 11:11 am EDT

Full-Scale Bear Market

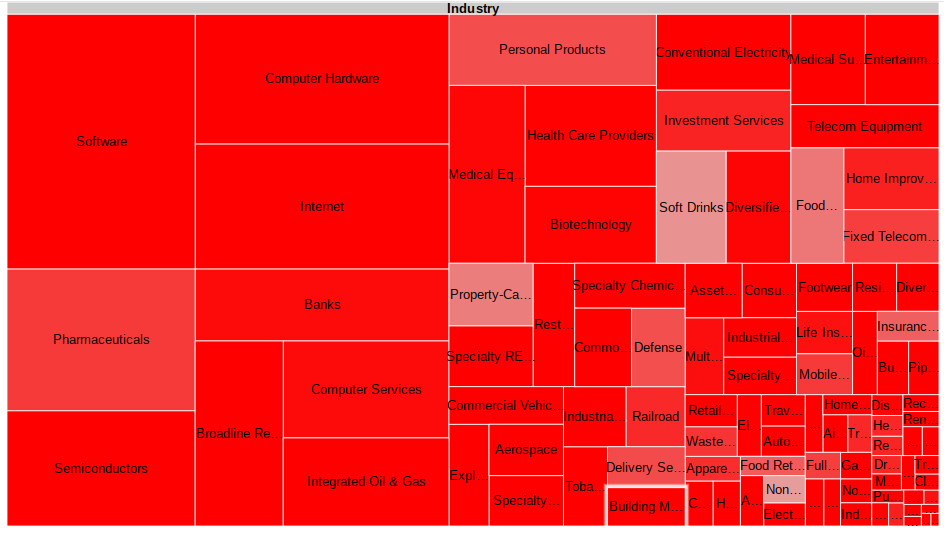

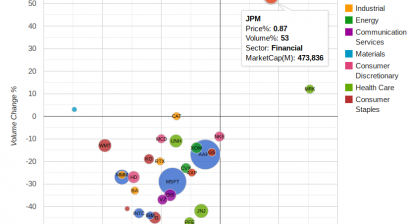

The full-scale bear market unofficially started today as we called it. Not only S&P 500 enter into the technical bear market zone with -20% down from the recent top, but also the record high of CPI and record low of consumer sentiment confirmed the economic trouble the stock market encountered.

Furthermore, the coming rate hikes started last month which means it is at the very early stage of the cycle. Balance reduction of quantitive tightening is on the plan to begin fully in September. All three major economic zones suffer all kinds of big troubles for the second half of 2022:

- Russia-Ukraine-European: wars, energy crisis

- US: inflation, the collapse of cryptocurrency

- China: COVID-19 lockdown, economy breakdown

Other parts of the world will face many uncertainties with the rising cost of energy and food. It would be hard to find a peaceful place in the world without worrying about skyrocketing prices of commodities and a potential shortage of food in the future.

It is the unwinding process to undo the damage created in the past 10-20 years of quantitive easing. Also, there is a price to be paid to allow Russia-China expands their power worldwide. US and European countries pursue their own benefits by working together with them for “globalization”. United Nation organization like World Health Organization allowed the COVID-19 to spread out to the whole world from China in January 2020. Similarly, United Nations Human-Right Organization confirmed there are no genocide or concentration camps in Xinjiang China. Mishandling of political and economical behaviors carried much deeper effects now.

In summary, this bear market would be severe enough to shock all of us because nobody has experienced before in our lifetime. The best strategy is to stay at the cash level and save as much as possible. It would be tough for the next 1-2 years.