June 14, 2022, 1:43 pm EDT

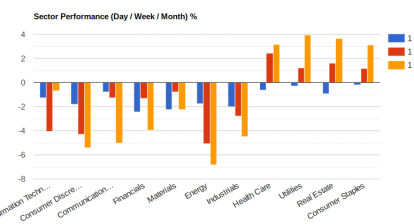

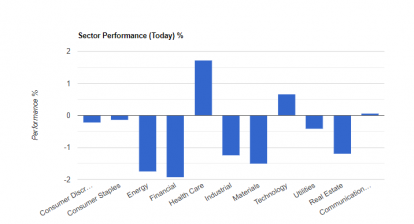

Hammered on both Offensive and Defensive Sectors

It is unusual to see the stock market hammers both offensive and defensive sectors. Offensive sectors and industries are mostly traded at a 52-week low. Many of the once-popular stocks are down 50-80% from their recent highs made 6 months ago (COIN, HOOD, RBLX, ZM, NFLX, ARKK).

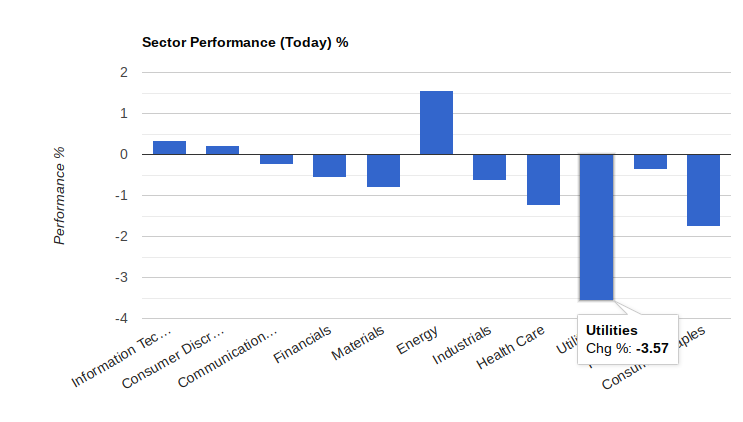

But, even the defensive sectors are not safe in this type of market as a utility (XLU) is down -by 3.6% today.

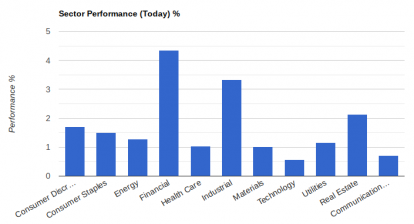

Basically, it illustrates that the investors are rushing to move around during turbulent situations.

Indeed, when inflation is out-of-control as shown in the latest Consumer Price Index (CPI) 8.6% and Producer Price Index (PPI) 10.8% most market participants do not know what to expect on how bad and how long the problem will persist.

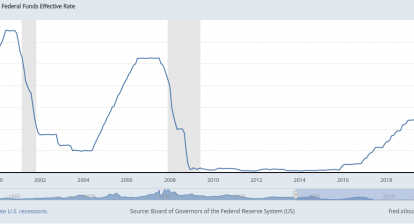

Asking this question to Federal Open Market Committee FOMC members, you will not get any reliable answer either. They may tell us they will raise 50 basis points or 75 basis points to fight inflation tomorrow. However, their viewpoint of ‘transitory’ inflation in the past 1-2 years was now totally wrong. So, do you think FOMC can help to deal with the inflation problem?

Most likely, the market will adjust itself to digest its record high valuation, balance sheet, debt, etc by scaling back to its true value in the next 1-2 years. In simple words, various bubbles need to burst in all categories including offensive, defensive, large, small, or any kind.

The market sweeps from the most volatile to the slow movers in the following orders:

- Nasdaq: technology, newly IPO, speculative stocks, social network, cloud, innovation

- Cryptocurrency: bitcoin, all coins

- Financial Institutions: Bankers, investment banks

- Established Retailers: Walmart, Costco, Target

- Industrial, Healthcare, Utility, REIT: all core and defensive sectors

It becomes harder to find safe investment vehicles except for cash positions. However, we shall see stabilization when inflation eventually comes down and market valuation, Shiller PE ratio returns to 10-15 level. This unwinding process could be painful but it will resolve the economy back to a healthy level again.

Meantime, the best strategy is to stay lightweight in investment and watch the market fix itself.