June 15, 2022, 4:50 pm EDT

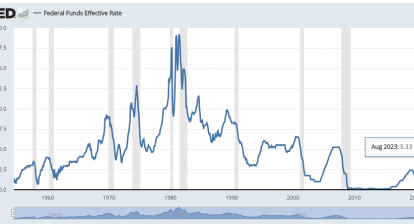

Fed Wanted to Catch Up

Fed wanted to catch up with the pace of inflation so it added 75 basis points or 0.75 percentage points of the Fed Fund Rate to a 1.5-1.75% level. Obviously, it was an aggressive action since 1994. However, we think it does not matter to the out-of-control inflation (CPI 8.6%) and falling consumer confidence (Consumer Sentiment 50.2). In simple words, it was too little too late.

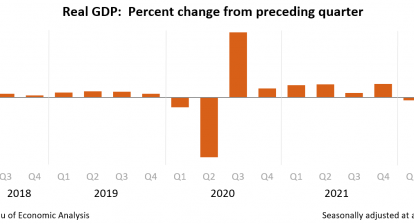

There are only two weeks left for Q2 2022 (April – June). What do you think about the GDP of Q2 2022? It does not look good in our opinion. Even if the GDP is positive, it would be roughly 1% or below. If the number is negative, then we need to accept the fact of the hard-landing of the US economy.

Technically, we believe that a new 52-week may come to the Dow Jones index that drags it to the bear marker as well in the next few weeks. Therefore, the second half of 2022 should be a major downtrend for the stock markets.

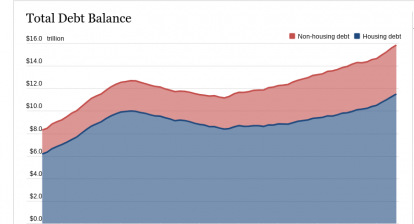

Cryptocurrency like bitcoin kept making a new low as a sign of collapse. It echos our observation that speculative assets are going to suffer the most. We think more industries like home builders, banks, and retailers, are going to show up their dismal earnings and performance soon.

Do not trust any bounce or rebound that is simply a dead cat bounce during a major downtrend. The best strategy is to stay mostly in cash positions to protect the portfolio. The opportunities will come again in the future. But now should be the time to enjoy the summer.