January 23, 2022, 11:16 pm EST

Bull-Bear Transition Series 2 – Rates, Inflation, and Debt

Let’s use economic data to look at the correlation and relationship between bull and bear markets. We can see how the US government and the Federal reserve use their power and tools like interest rates to drive up the financial markets. But, there are prices to be paid on the other side which are inflation and debt. There is a direct link between monetary easing policy with higher stock prices and tightening policy to cool down the overheated markets.

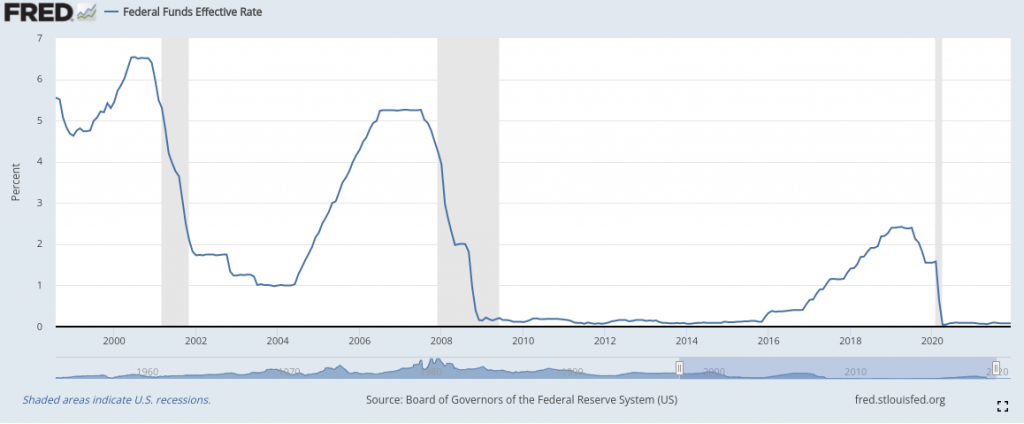

Rates – Federal Fund Rate

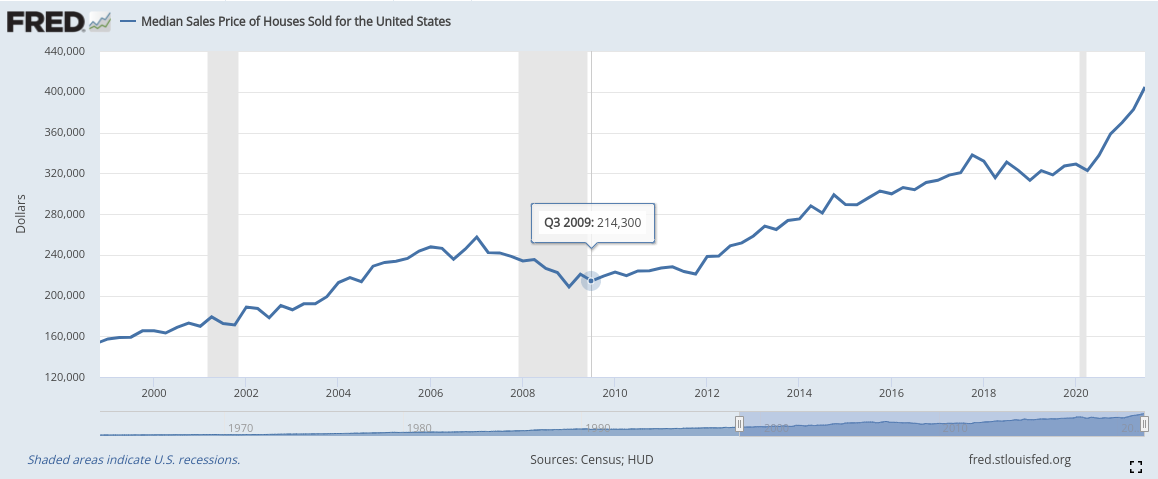

Alan Greenspan, the chairman of the Federal Reserve during the early years of 2000, reduced the Fed Fund rates from 6.5% to 1% in order to stir up the US economy after the dot-com bubble during 2001-2002. The record-low interest rates with many other government policies that encourage people to buy houses, so-called affordable housing drove up sub-prime mortgage lending. The government, banks, and individuals worked together to create one of the greatest bubbles that burst during the 2007-2008 bear market.

In order to rescue the beaten economy, US President Obama introduced many rounds of the stimulus plan together with near-zero interest rates again. Interest rates were adjusted a little bit higher to about 2.5% when President Trump took the presidency. But, it quickly became near zero again when president Biden took the white house.

Dow Jones made +7.25% and +18.73% gains in the years 2020 and 2021, respectively.

This method of lower rates worked effectively well for the stock market because of the rising housing markets.

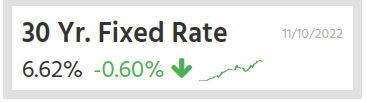

However, record median prices of 400K and +100% gains of Dow Jones (March 2021 – January 2022) created the overheated markets. Combining with other easing policies (stimulus plan, COVID-19 checks, trillion-dollar infrastructure plan, etc), the whole world experienced the rise of commodities from food, energy to almost all items. Thus, we should expect this week’s Fed Open Committee Meeting (FOMC) to address the plan for rising rates in detail.

The problem is that the timing could be too late now unless Fed takes more aggressive actions. It would be difficult for the Fed to adjust the rates properly so that it controls inflation and maintains economic growth in a balanced way.

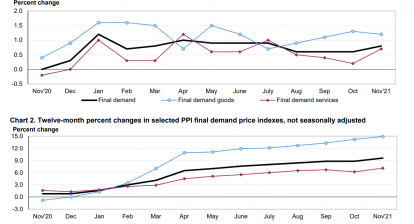

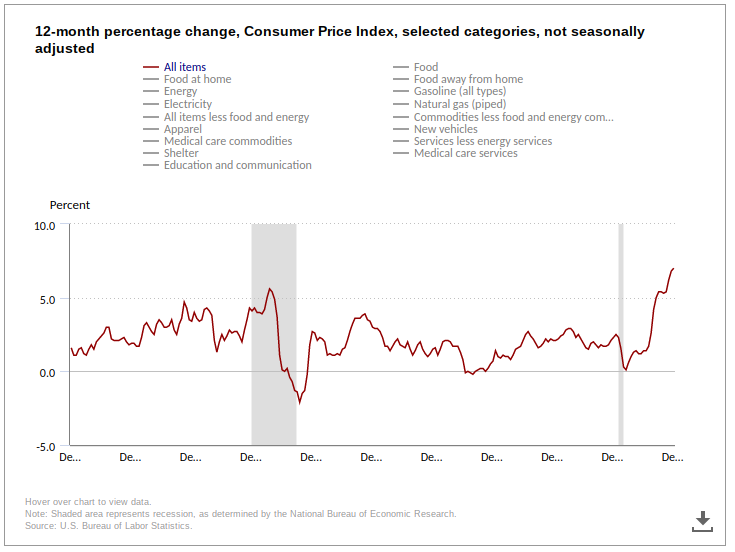

Inflation – Consumer Price Index

As stated before, an easing policy would make price labels go higher. Consumer Price Index or CPI presented the outstanding high 7.0% CPI that is at 40 years high (the next highest is 1981 10.3%). Inflation or the high cost of gasoline and food already created problems for many people. Thus, aggressive tightening policies are likely to happen in order to cool down inflation. By doing so, it would press down the stock markets for sure. It is only a matter of how fast it drops.

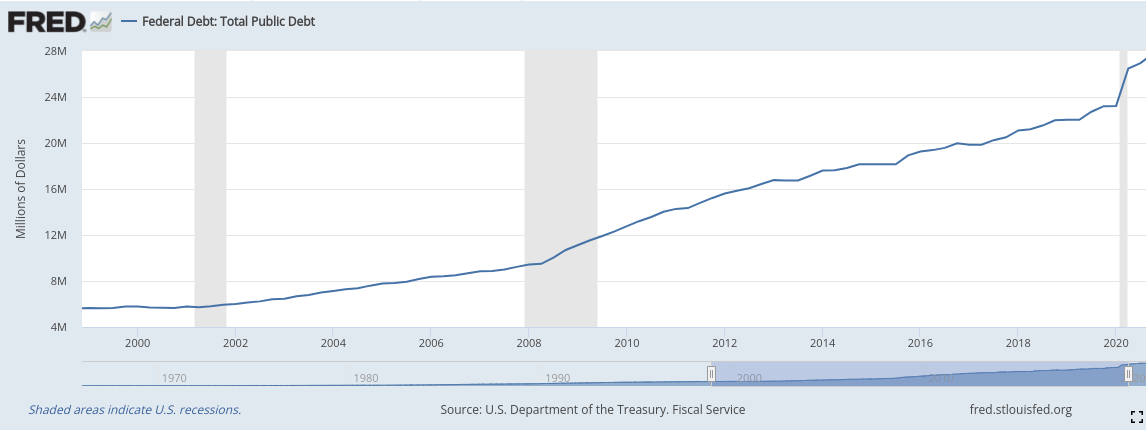

Debt – Federal Debt

Lastly, record numbers of government debt of 27 trillion are another mess to deal with. Higher rates would cause the higher hurden to pay back with higher cost. In the past, Congress always increased the debt limit in order to work on the budget but it did not solve the problem at all. In fact, it made things worse. We should see the US government begins to address this issue soon. Consequently, its impact would be negative for the stock markets if it does not control properly.

In summary, rate hikes, inflation threats, and rising debts are crucial to the health of the US economy. Changing its policy from easing to tightening would help to solve it. Nevertheless, the stock markets should reflect its results on the way down. We do not know whether it would drop suddenly or slowly. But, these factors should be strong enough to switch the bull to bear.