August 24, 2022, 12:26 am EDT

The Resurgence of the Energy Sector

Crude oil spikes up about 4% today. According to Reuters, OPEC may want to cut the supply so that the crude oil price can increase again for higher profits. It is important to note that oil prices directly control the inflation pressure.

The stock market enjoyed a rebound during the past couple of months based on the hope of improved inflation. Of course, the decline of the crude oil price from $122 to $87 is the primary driving force. Therefore, if the oil price decides to move up again, then the future of the stock market may be in jeopardy again.

Recently, Saudi Arabia turned down a suggestion from US president Joe Biden to increase its oil production. China Xi could visit Saudi Aribia to fill in the gap and replace the position left by the US. It could complicate the relationship between China, the US, and middle alliances. Furthermore, the Russia-Ukraine war keeps dragging a big unknown for both crude oil and natural gas prices. We consider oil prices worthy of attention for both inflation and the US economy. In summary, the rise of oil will likely hammer the stock market again in our opinion.

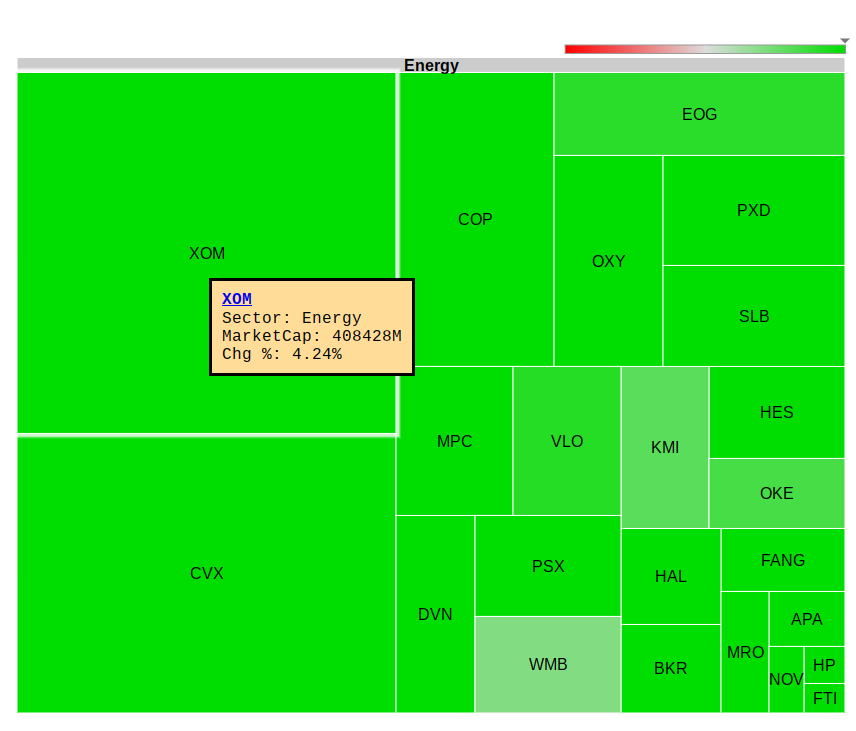

Lastly, the spike in oil could provide investment opportunities for the entire energy sector. The all-green color displays the array of stocks to watch or add to the portfolio when the upside momentum continues.