November 20, 2022, 5:26 pm EST

Bulls Are Still Alive

It could be hard to imagine why bulls are still alive after a series of rate hikes and high inflation. Also, the stock markets remain strong where the Dow Jones index is about 8% from the historical record high. We cannot deny that Nasdaq is in trouble with -29% YTD performance. But, we are also aware that did not get fully into the bear market area yet. It is only -17% down YTD.

There are two primary reasons that the stock market is strong under a weakening economy: the housing markets and job markets.

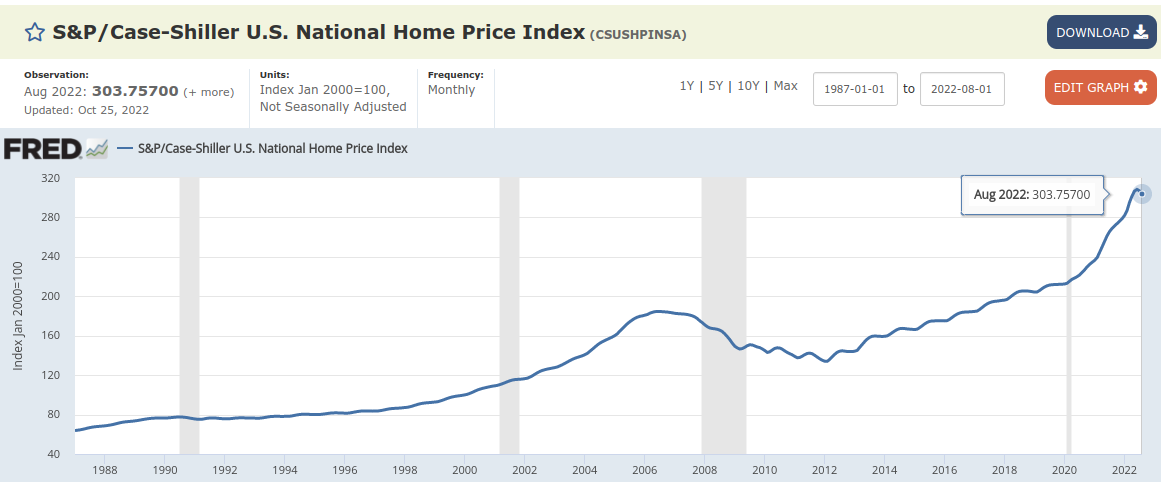

Housing prices are important factors to determine consumer power. Especially, homeowners who bought houses at relatively low points a few years ago or longer have plenty of equity available. That equity can be cashed out through a home equity line of credit. It provides plenty of cash to spend in an inflation environment.

Unless home price plunges to the 2011-2012 level, most home buyers still have some equity if they bought a house about 10 years ago. This reserved cash provides a certain amount of buffer to sustain the stock market, in our opinion.

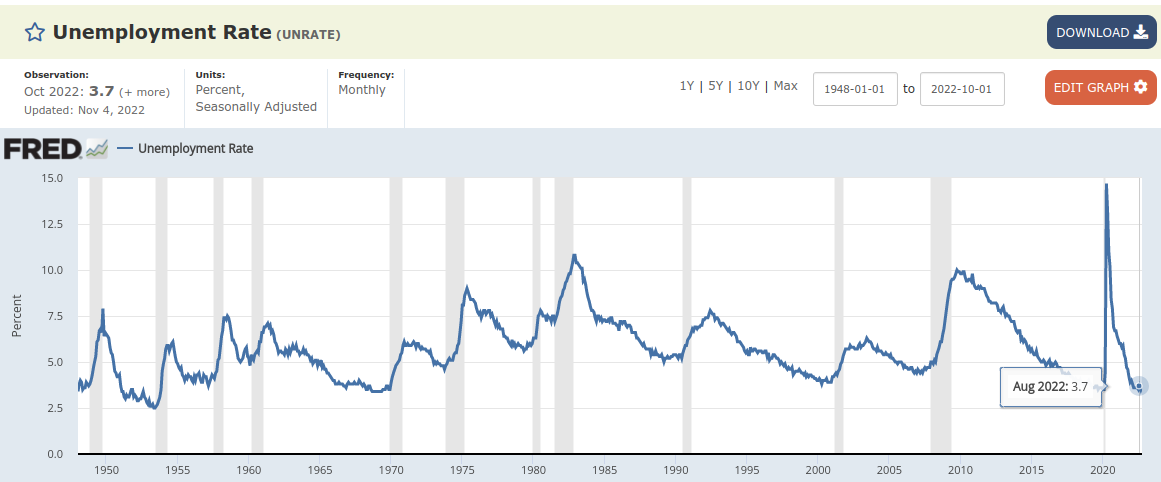

Another factor is the job market. Although massive layoffs are coming now and should get higher for months to come, the unemployment rate is still at a multi-decade low of 3.7%. Please see the chart since 1950 that 3.7% is a really low level historically. Therefore, most people still have cash flow into accounts to pay the bills.

However, it is important to note that both conditions are going to deteriorate significantly in 2023 for sure. So, the strong bulls may not last long. The bull’s party is still on but it is near the late stage. The main point is that bears need to patiently wait for their moment to come because of the housing market and job market.

In brief, bulls are still alive but the day of collapse will come when housing and job markets fall off the cliff.