November 23, 2022, 12:02 pm EST

Divergence

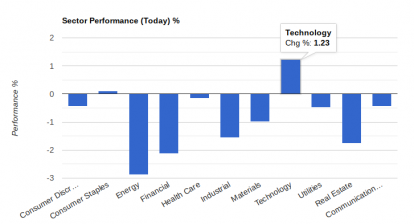

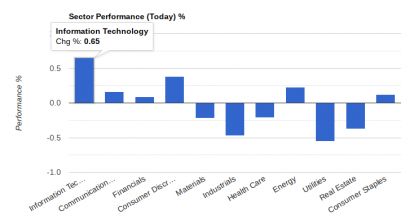

Dow Jones index scored nearly 19% gains for the past 5 weeks with a straight-up rally that is very unusual in history. However, we can see a divergence between Dow Jones and Nasdaq. Nasdaq is far behind both Dow Jones and S&P 500. Understanding the difference in this phenomenon could help us understand why aligning with market rotation is essential.

The breakdown of cryptocurrencies like FTX, the bursting of meta verse (META), and over-expansion of online retailers (AMZN), and massive layoffs for fragile social network companies (TWTR, SNAP) work together to bring down the Nasdaq.

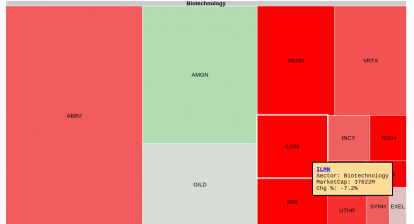

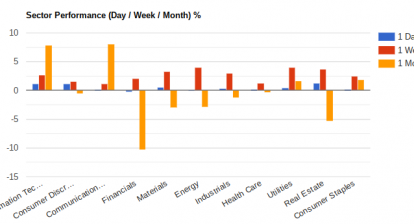

However, the brick-and-mortar businesses like material (steel, copper), industrial (defense, equipment),, and pharmaceuticals (bio-tech) enjoyed their good time when inflation is likely to stay much longer with the dovish attitude from the Fed reserve.

Recently, Fed officers expressed the intention of the slowdown of rate hikes in December citing the peak of inflation. Although it could be true for the observation, the threat of high inflation (> 2%) is still fatal to the US economy.

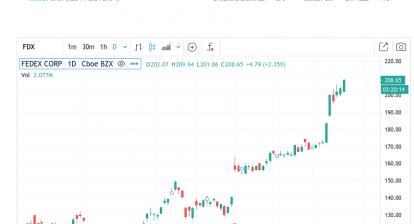

Smart money understood the outcome for 2023 so they rotated money from the high-flying tech to the real businesses.

We believe this situation will continue into 2023 when Dow Jones & S&P outpace Nasdaq. Furthermore, stock picks are necessary skills to get the right components in the portfolio for survival and prosperity.