March 7, 2023, 12:06 pm EST

The Power of Saving: Certificate of Deposit

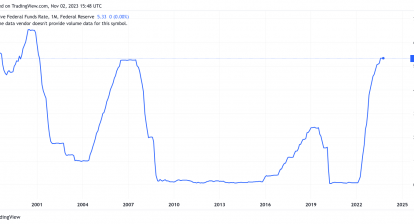

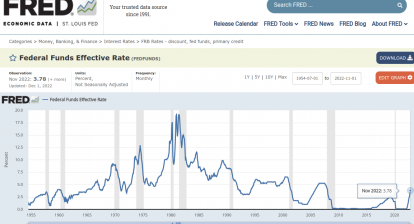

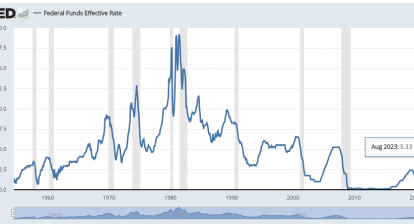

It should be no surprise when Jerome Powell insisted on raising Fed fund rates for a period of time or called it “likely to be higher”. The failure to control inflation after a year-long effort is manifested.

Individuals began to tighten up their belts because they see everything become more expensive like eggs, milk, etc. Businesses also suffer smaller profit margins squeezed due to the higher cost of materials and fewer sales.

Investors and traders are quiet rather than cheers about making money due to doomed stock markets.

The only group smiles are those with savings because higher rates mean higher returns.

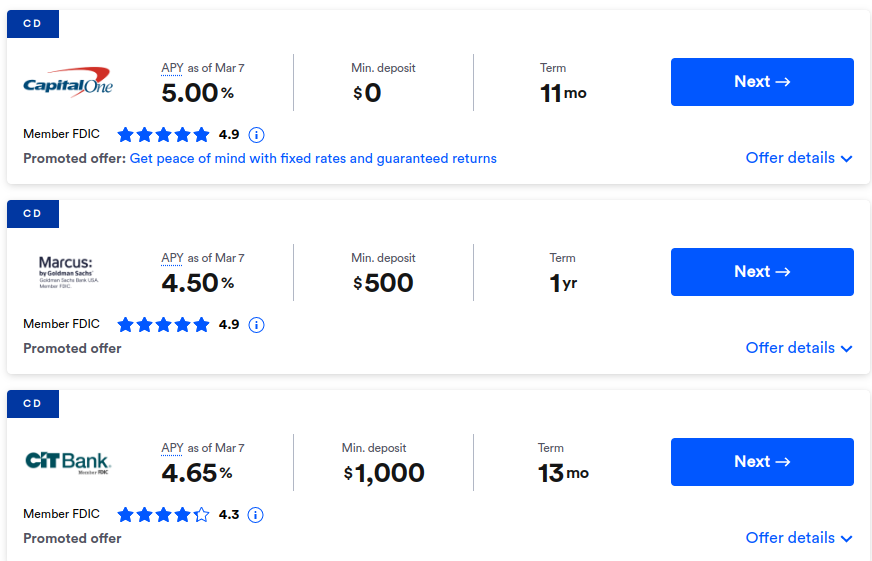

While the Fed fund rate is at the 4.5% range and going higher, the Certificate of Deposit (CD) rates march higher as well. For example, you can find the best CD rates where more than five banks offered rates between 4.5-5.0% for an about 1 year duration. Those FDIC-insured CDs almost mean risk-free earnings.

It is important to have savings for the future. Instead of spending on fancy cars, you can buy a reliable car for half of the price and save the rest. For example, 5% of $30000 equals a $1,500 income source. Furthermore, keeping the saving habits will allow you to be independent of working for money for the rest of your life. A 5% of one million means $50,000 annual income or more than $4,000 a month.

Other investment methods could carry higher risks of losing your capital. But CD is one of the safest investments everyone should consider when the interest rates are higher.