December 14, 2022, 8:33 pm EST

Breaking Even

Bulls and bears are breaking even after Fed adjusted another 0.50% to 4.25-4.5% after December hikes. Although this level is the highest in the past 15 years, we believe the rates could be much higher for years to come. It is possible that the rate could reach double digits like in the 1980s.

Excess liquidity released by the Fed reserve in the past 10-20 years is not going to stay there without inflation. We believe this is the early stage of the inflation era.

However, both bulls and bears are temporarily satisfied with Fed’s approach by slowing down its pace. The short-term picture is bullish while the long-term view is bearish. It makes an assessment of the market conditions complex.

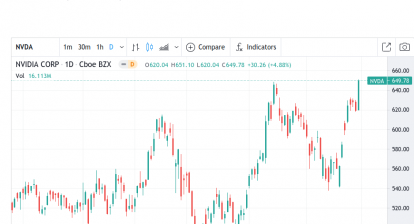

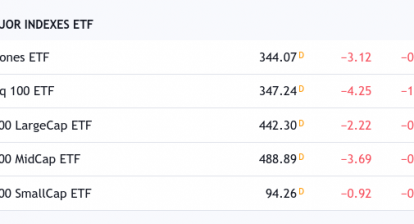

Technical speaking, three major indexes also belong to different categories:

- Dow Jones: Bullish (above 20, 50, 200 day-moving-average lines)

- S&P 500: Neutral (at 20, 200, and below 50 day-moving-average lines)

- Nasdaq: Bearish (below 200, at 20, 50 day-moving-average lines)

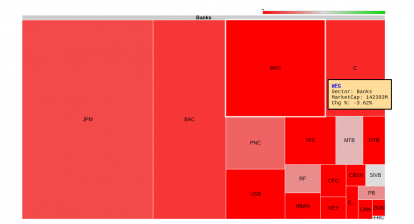

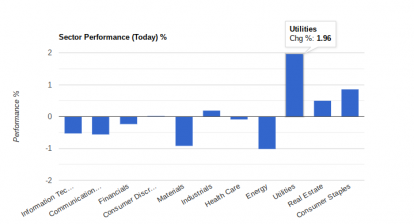

Stock performance is heavily depending on how many Dow Jones and non-tech stocks you owned. The outlook of the stock market also relies on certain sectors, industries, and individual stocks.

We believe this trend is going to continue which means the stock leaders are large-caps, defensive types (healthcare, consumer staples), inflation sensitive (material, resources), and defense types (fighting jets, missiles).

There are many risks that could serve as triggers to pull the market into the deeper ground like diseases, wars, and financial bombs (ex: cryptocurrency). But, we will never know before they occur.

Thus, stay bullish as Dow Jones tells us. Also, stay bearish as Nasdaq warns us. We think this is the best posture for this market.