March 10, 2023, 12:27 pm EST

FDIC Coverage Limits

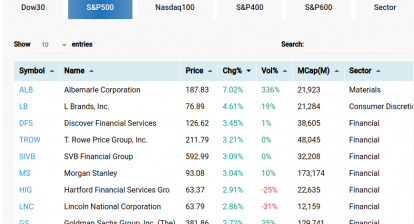

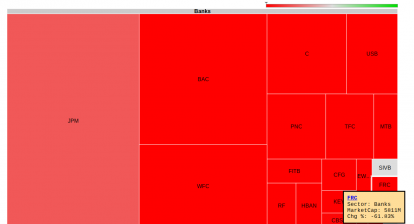

We covered SVB Financial Group (SIVB) 03/09 Investment Banks in Trouble that tumbled -60% yesterday. After hours of trading, it drops another -60%. This morning trading on SIVB is halted and SIVB may be gone forever as SEC is involved in dealing with the company and its investors for the chaos after the shock.

It is rare for an S&P 500 company with a 30-40 billion market cap (2021) to come to an end within 1-2 days. In the following process potential bankruptcy chapter 7 or chapter 11 will decide whether other buyers want to buy SIVB to restructure its obligations. Usually, bondholders and shareholders may get whatever is left after the liquidation of their assets. Usually, it would be a tiny amount or nothing according to the conditions.

The important lesson for us is to learn how to protect ourselves when we put our money outside our control. Usually, our assets are allocated in the following categories:

- Cash or cash equivalents: Checking account, saving account, CD, cash under the mattress

- Financial Accounts: 401K, IRA, brokerage accounts, stocks, ETFs

- Tangibles Items: jewelers, watches, gold, diamonds, cars, boats

- Unmovable Assets: houses, lands

The key is to make sure the valuable items are under insurance protection. It gives you the last defense to reduce the damage when unexpected events occurred which is happening every day.

In the SIVB case, the bank is under FDIC (US Federal government) insured up to $250,000 per depositor. Most big banks like Bank of America, Citi, Chase, and Wells Fargo, are also under FDIC coverage.

Please do not assume some banks will not go bankrupt like these big banks. In fact, during the 2007-2008 subprime crisis, some of these banks were nearly bankrupt but saved the US government through so-called bailout programs. Even the insurance company AIG was almost belly-up if the US government did not get involved.

If you apply this kind of mindset to manage your money, you will be very careful not to lose any penny of your hard-earned money. In both unusual cases (bankruptcy) and common cases (losing money after buying a stock) we should be very seriously thinking about how to protect our assets.

Using FDIC insurance is one thing. The more practical application would be carefully selecting stocks to buy, watching their development, and cutting losses short to avoid a big loss. These are survival lessons we should learn in managing our own money.