March 13, 2023, 5:49 pm EDT

Crunch Time

Although the stock market index looked stable today (DJIA -0.28%, S&P 500 -0.15%, and Nasdaq +0.45%), we consider today could be a crunch time or critical moment/period when decisive action is needed.

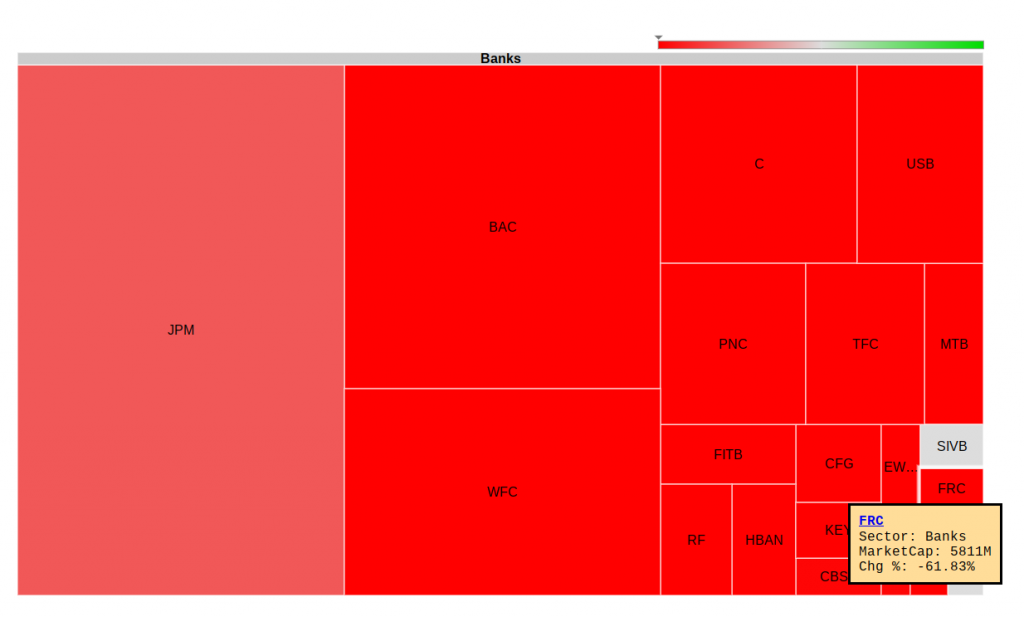

The Fed government decided to rescue depositors of Silicon Valley Bank (SIVB) so that they could retreat their full amount of money instead of $250,000 FDIC coverage. It should be good news for these people. However, this action may not be good news for the rest of the financial institutions like regional banks, and investment banks from their performance today:

- FRC -61%

- CMA -27%

- KEY -27%

- ZION -25%

- TFC -17%

- HBAN -17%

- FTB -13%

- SCHW -11%

- CFG -11%

Because the government does not save the troubled banks so their fate is still the same: shutting down.

The future of the stock market is at great risk if more bubbles are bursting like Silvergate, Silicon Valley Bank (SIVB), and Signature bank (SBNY) for the months to come. The consequence of inflation and rising rates began to spread out. Layoffs from Mega technology companies, banks closure, or any other events could eventually bring back the bear market which is highly possible, in our opinion.

Meantime, the cryptocurrency market also went through a turbulent period down and up more than 10% last Friday and today. BitCoin recovered back to the 24,000 level. But this kind of wild behavior is not bullish at all. Usually, it is a sign of high volatility and chaotic actions.

Finally, gold miners’ ETF (GDX) was up +7%. It reflects the reality of investors to brace the most reliable material – the precious metal gold and silver when uncertainty is the name of the game.