July 20, 2023, 11:07 am EDT

Overbought condition and Catchup Rally

It is important to understand the condition of the current market in either overbought or oversold condition so that one can avoid chasing the rally or selling at the worst time. Usually, the opposite action would come after the extreme bias.

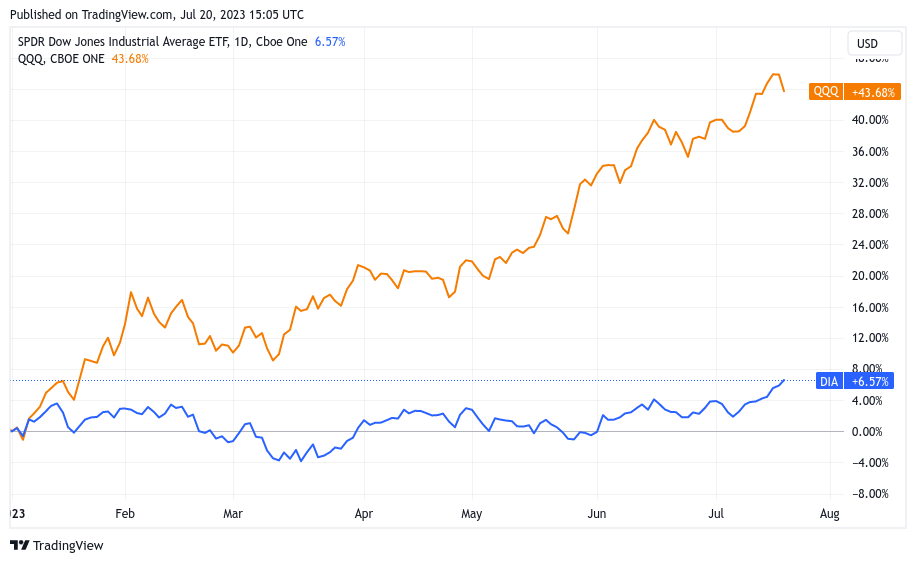

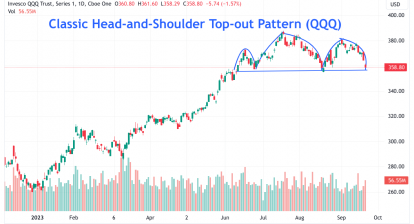

For example, Nasdaq-100 (QQQ) has rallied with 40%+ gains since the beginning of 2023. No doubt it is at the overbought condition according to the moving average lines of 20-day (short-term), 50-day (medium-term), or 200-day (long-term). Buying QQQ around this level is highly risky for the coming pullback that could be sharp and deep.

This is precisely what we see today after the earnings report from NFLX -9% and TSLA -7%.

Conversely, Dow Jones ETF (DIA) is trying to catch up with the rally since it only accumulated about 4% year-to-date gains which are far behind QQQ or SPY.

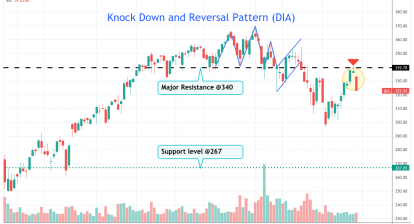

We believe the unwinding of QQQ and the advancing of DIA will continue for the next few weeks until markets reach equilibrium status.