Fellow

Fellow groups

Stock Market Today: Technology Under Pressure

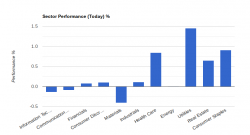

When the technology focus Nasdaq index is under selling pressure as we pointed out yesterday, it spells out a cautious signal. Furthermore, defense sectors rose quickly today as shown.

Stock Chart: Major Breakdown from Nasdaq 100 (QQQ)

Today is a major breakdown day for the Nasdaq index. A picture is worth a thousand words as shown in the featured chart (QQQ).

Stock Market Today: Energy and Financial Rally

September 28, 2021, 12:45 am EDT Energy and Financial Rally Energy (ETF: XLE) +3.6% and financial (ETFL XLF) +1.4% sectors rallied today to boost the Dow Jones Index with 71 gains or +0.2%. It stood o...

Stock Picks: Build For What’s Next? – SVB Financial Group (SIVB)

The power of regional banks may not be well-known for investors and traders. They are not as big as money center banks like Bank of America, Citi, or shining as investment banks Goldman Sachs, Morgan ...

Stock Picks: Fast Growth Oil and Natural Gas Energy Leader: Devon Energy Corp (DVN)

September 23, 2021, 11:50 am EDT Fast Growth Oil and Natural Gas Energy Leader: Devon Energy Corp (DVN) The energy sector is the strongest sector based on today (+3.2%) and one-month (+7.8%) performa...

Stock Picks: Snap the Opportunity – Snap Inc (SNAP)

September 22, 2021, 4:08 pm EDT Snap the Opportunity – Snap Inc (SNAP) Recent legal trouble of Facebook (FB) may give its competitor Snap Inc (SNAP) an opportunity to take over the leadership in...

Stock Chart: Rise or Fall? That’s the Question

September 21, 2021, 12:06 pm EDT Rise or Fall? That’s the Question Rise or fall? That’s the question everyone is concerned about after a -600 drop or near -2% down in major indexes yesterday. It...

Stock Market Today: Global Markets Sell-off

As we mentioned last Monday (09/14) on the Collapse of China Evergrande Group, today global markets began to react by selling off. Dow Jones tumbled more than -500 points and Nasdaq is down more than ...

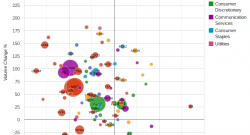

Stock Volume: High Volume Turnover on Mega Technology

September 17, 2021, 6:27 pm EDT High Volume Turnover on Mega Technology Volume matters. When the trading volume of a stock is far above the average volume above 50% or 100%, it means that a large crow...