June 15, 2021, 10:47 am EDT

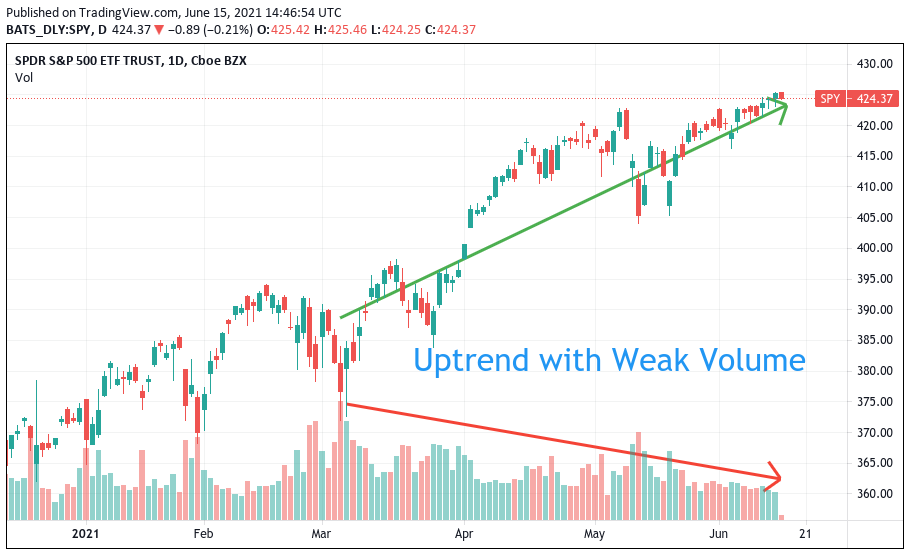

Uptrend with Weak Volume

Uptrend makes people excited. But volume tells you the power behind the rally. Volume represents transactions on a given day. Only big players or institutional investors like fund managers (hedge fund, mutual fund) can bring in massive amounts of volume. In most cases, they show you the commitment to the overall market for months or years to come.

For example, S&P 500 (ETF: SPY) was up +13% (from 375 to 424) in the past three months including many new record highs. But, the volume became weaker and weaker. It means that only small groups of people chasing the index to the uptrend.

This is not a bullish signal. Instead, it is a warning signal. The lack of a strong foundation and pillars makes this rally suspicious. It is a good idea to constraint from new positions. Furthermore, trim down weak positions and watch the storm when it comes.