February 7, 2022, 11:56 am EST

Nasdaq Leads To the Downside

In the bull markets, Nasdaq is the leader to the upside. But in the bear market, Nasdaq becomes the leader to the downside. The reason is easy to understand as shown below:

- Nasdaq consists of more stocks in the technology and new market

- Innovation generates higher growth but less reliable income

- In the bull market, investors chase the growth stocks but in the bear market, investors prefer steady income or dividends.

More importantly, a company needs to have a healthy balance sheet in order to survive harsh conditions. Usually, companies will turn belly up or die when they cannot make enough money to pay the debts and bills.

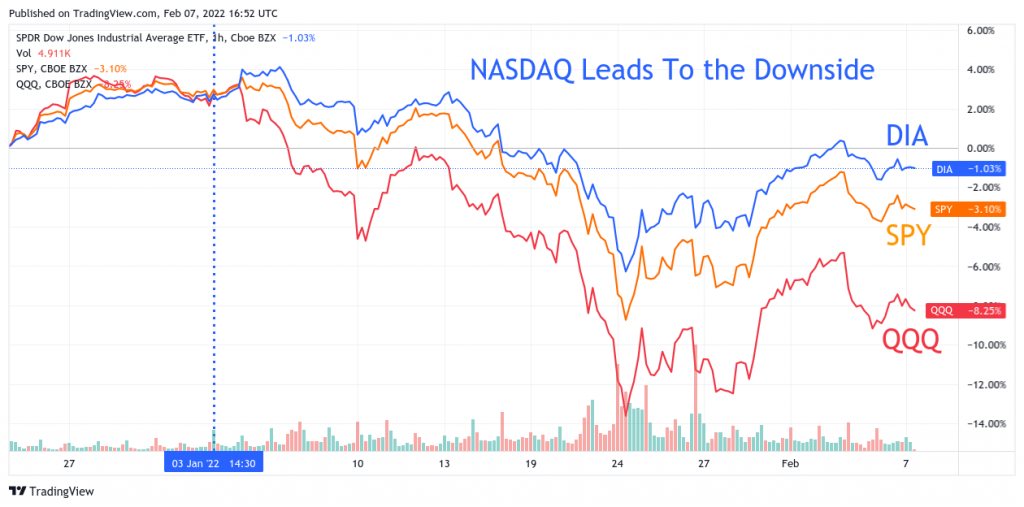

Using the featured chart we can see the comparison clearly. Dow Jones (DIA), S&P 500 (SPY), and Nasdaq 100 (QQQ) are displayed together in one chart. Obviously, QQQ changed its leadership from the upside to the downside on 01/01/2022. Currently, S&P 500 is in the middle and Dow Jones becomes the strongest one.

Energy, financial, healthcare, and consumer staples sectors contribute winning formula for Dow Jones where Nasdaq is short of these stocks.

Therefore, if a person wants to buy an index fund, DIA should be a better choice assuming bears are on the way.