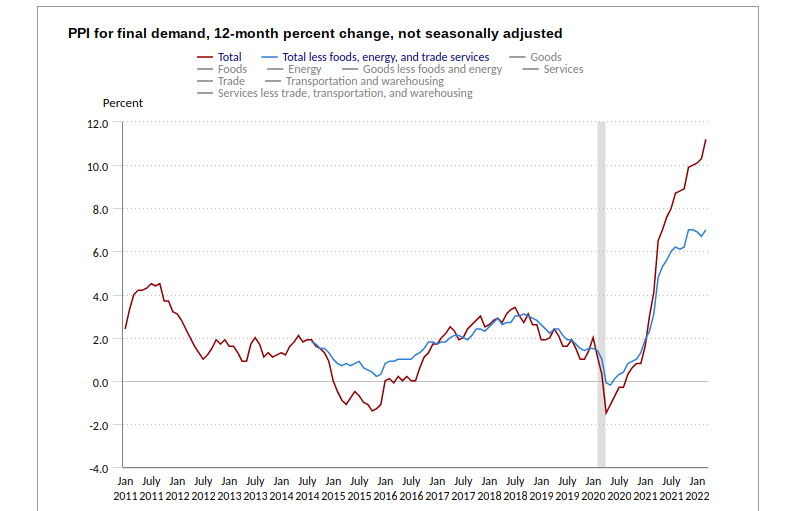

Record High Producer Price Index

Following yesterday’s consumer price index, today’s wholesale data or Producer Price Index (PPI) reached another record high of 11.2% year-over-year increase as shown in the featured chart.

The stock market reacts in a bullish way in the morning trade by hiking 180 points in the Dow Jones index and 200+ points in Nasdaq or +1.5% gains as of now.

Looking into the leaders there are a bunch of consumer-related stocks in airlines, hotels, restaurants, travel, cruises, etc.

- Airlines: AAL, UAL, DAL, LUV

- Hotel: MAR, HLT, LVS, MGM, CZR

- Restaurants: CMG, CAKE

- Travel: BKNG, ABNB

- Cruises: RCl, CCL, NCLH

- Mall: M

Does it make sense that the higher prices of goods and services mean more businesses in the future for the consumer-related companies? It does not unless this number is the peak which means the worst might be over. This is the same logic we mentioned yesterday.

We take a more cautious viewpoint by focusing on what happens now instead of looking ahead aggressively to the future.

However, the other side could be true that the worst is here or the good time is coming. Therefore, we put this information in the background and watch its development from both the stock markets and economic data. In most cases, the stock market provides a short-term reaction and economic data offers a long-term reality. Depending on the timeframe of the investment, each individual needs to understand the holding timeframes so that interpret various data accordingly.