June 8, 2022, 10:47 pm EDT

Tight Consolidation Range

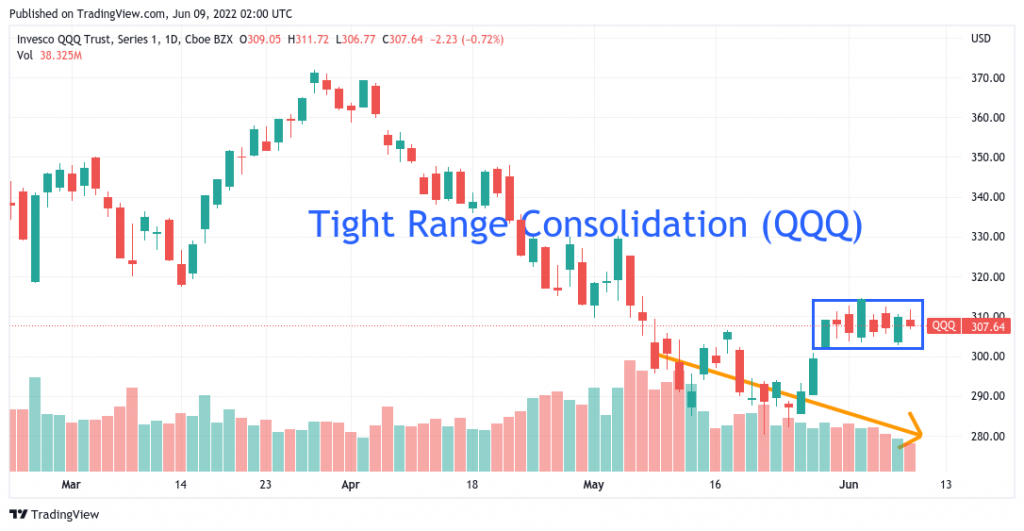

What does it mean when the stock market moves within a tight consolidation range? Technically, having a narrow range of activities like Nasdaq-100 (QQQ) and declining volume indicate that the market is waiting for something before its next move. Then we could ask, “What is the something that market is waiting for?”

It is possible that Friday (06/10) Consumer Price Index (CPI) report on May is the one. April CPI number was 8.3%. However, if we check out the crude oil price that kept rising in May and made another local high of $123 per barrel, then we can guess the inflation number may not look pretty in May.

Basically, it is our view that the US economy will be hit hard when the inflation gauge is out of control as we experience now for the highest level in the past four decades.

The tight consolidation range gave market participants a chance to hold a wait-and-see attitude until the truth reveals. However, the other situation could happen that CPI goes down a lot to surprise everyone. It could give the stock markets a reason to break out to the upside. But we tend to believe this chance is lower.

We need to remember that inflation is the key to determining the market’s next move. So, let’s sit tight and prepare for it.