Recession or Not Recession, That’s the Question

Does it matter if we call it a recession or not? That’s a good question.

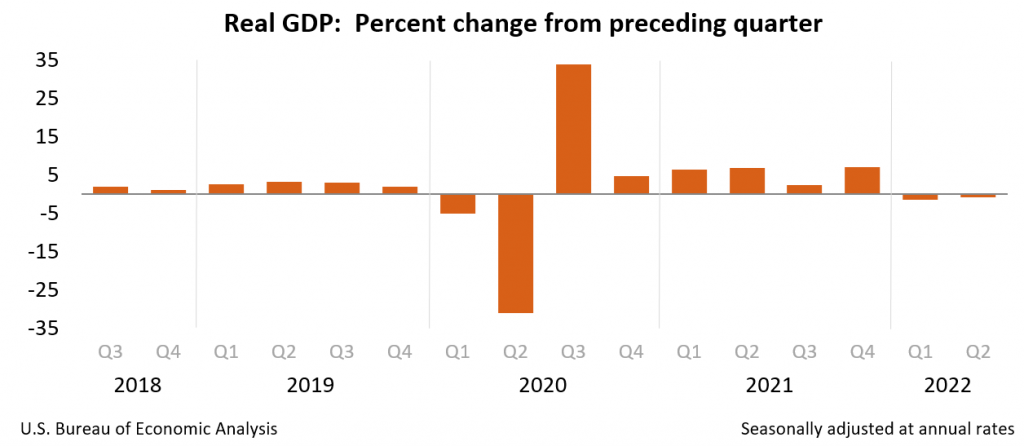

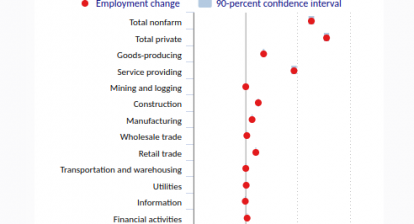

Though there is no global consensus on the definition of a recession, two consecutive quarters of decline in a country’s GDP is commonly used as a practical definition of a recession. In the United States, a recession is defined as “a significant decline in economic activity spread across the market, lasting more than a few months, normally visible in real GDP, real income, employment, industrial production, and wholesale-retail sales” — Wikipedia

2022 Q2 GDP -0.9% and Q1 GDP -1.5% do not mean recession, according to Treasury Secretary Janet Yellen. US economy is in a “state of transition, not recession” as Janet mentioned.

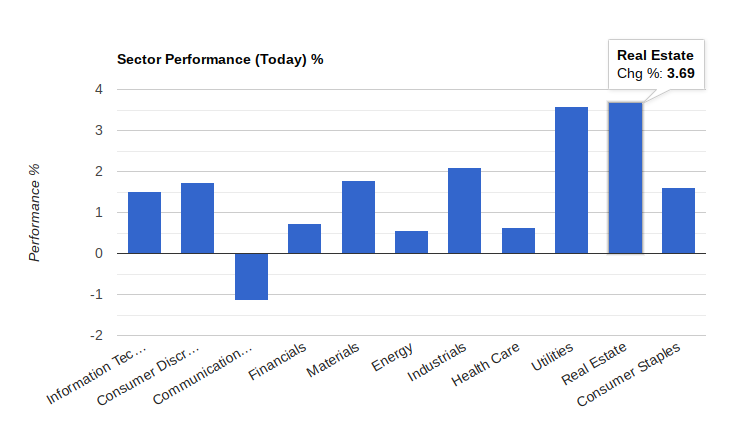

Perhaps, the stock market listened to her words so major indexes were up more than 1% for a fresh new 6-week high since mid-June.

However, when looking closer at the leading sectors we noticed different pictures. The leading sectors are REIT 3.&% and Utilities 3.6% which belong to the defensive sectors.

Our interpretation of this GDP reaction is similar to Jerome Powell’s famous word “transitory” on inflation during the past two years. In general, it will work for a while until the next triggering event to uncover the truth. We believe the problem will be bigger in the next 6 months for the economic slowdown and shrinking business activities. Thus, we will be very careful in handling portfolio arrangements.

Meantime, the market still offers opportunities to look for potential leaders in this “state of transition”. It includes breakout from the clean energy stocks (NOVA, BE, FSLR, ENPH, PWR, RUN, PLUG, BLDP), and other areas like restaurants (EAT), industrial (PWR, ROL), etc.

We do not think the rally can go very far but it could be worthy of attention to consider some positions for the portfolio.