November 14, 2022, 10:49 am EST

Dollar and Commodity

The US dollar and commodities have a relationship of inverse correlation. It means that they go in opposite directions in general. The reason is that almost all raw materials (oil, steel, copper, nickel, , natural gas, gold, silver) are traded in the commodity market based on the US dollar. In some cases, a sudden rise or fall of the dollar could produce a decrease or increase in commodities so that a balance can be maintained. This is the basic principle between the currency market and the commodity market.

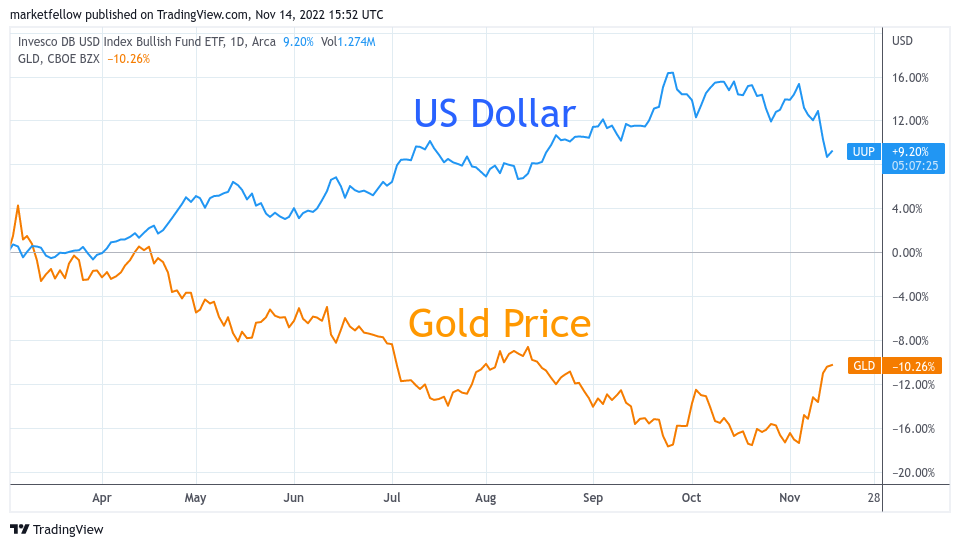

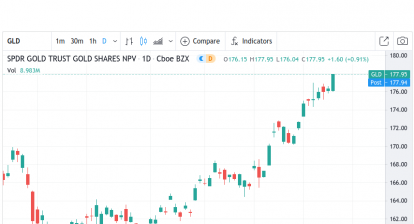

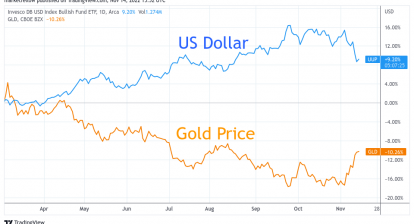

It is interesting to observe this situation has occurred recently. We use the dollar ETF (UUP) against gold price ETF (GLD) to point out these inverse correlations as shown in the featured chart.

The fall of the dollar reflects the expectation of inflation measures (CPI) and the Fed’s slowdown of rate hikes.

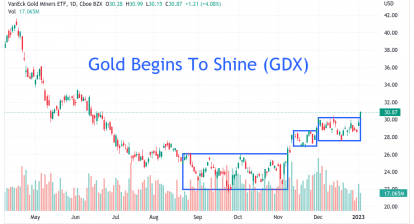

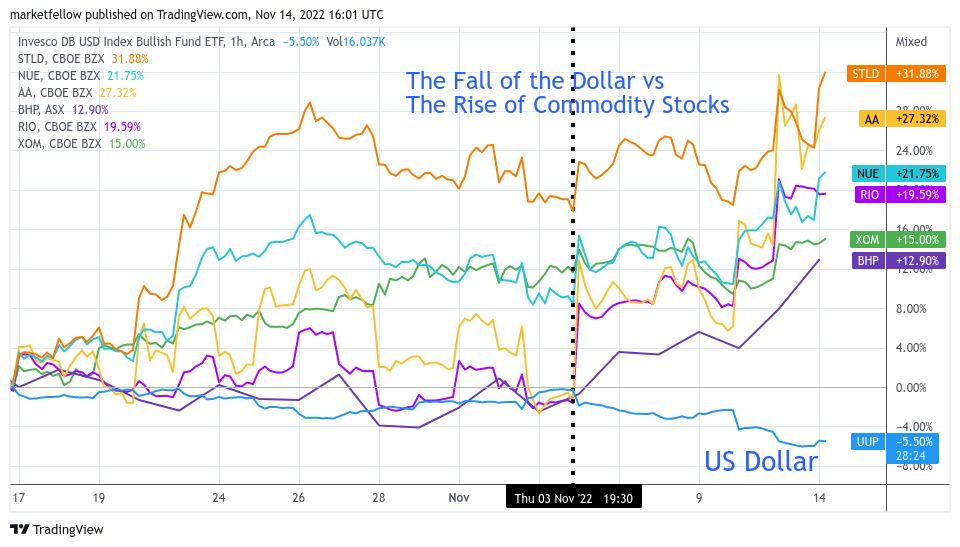

We can also use individual commodity stocks against the dollar to monitor this change. As long as this relationship remains, the dollar fall could offer opportunities to invest in commodity stocks.