December 12, 2022, 8:02 pm EST

Peak-out Inflation and Dovish Fed Reserve

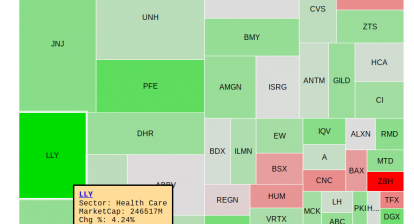

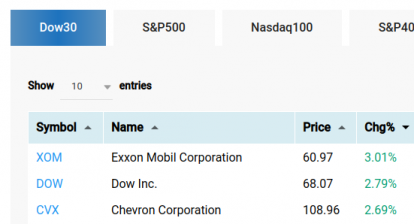

Peak-out inflation and dovish Fed reserve are two critical factors to add fuel for the stock markets since mid-October. Today could be another day for this bullish mood with DJIA up more than 500 points.

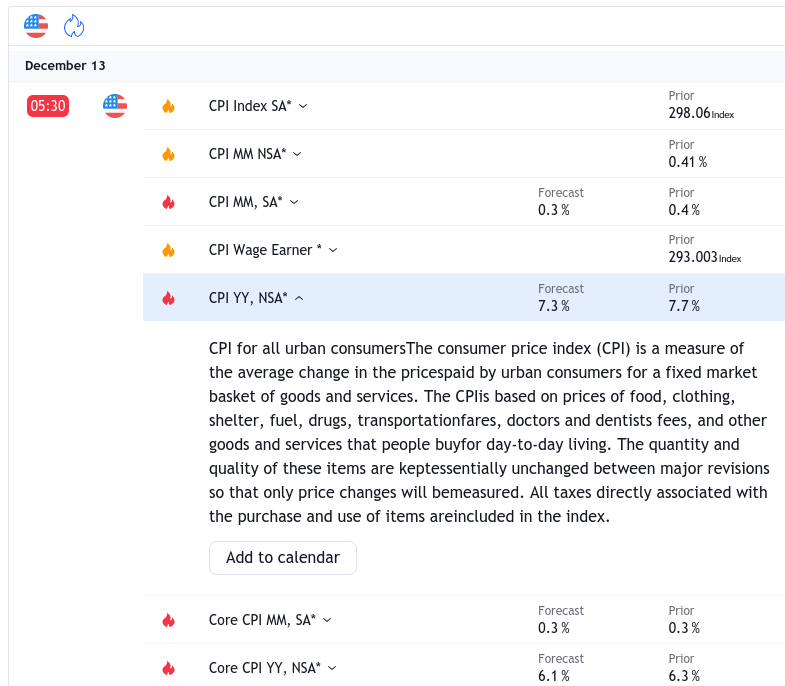

But, tomorrow’s Consumer Price Index report could create certain power in either direction for the stock market also. It was forecasted to be 7.3% vs 7.7% prior data point.

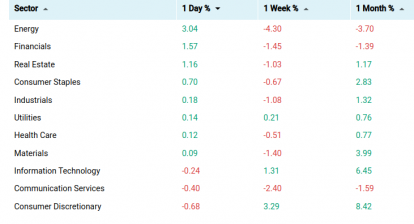

Recently, crude oil prices came down from $122 in June to $73 today which is definitely evidence inflation cools down in the past 6 months.

It is also how Fed observed the change in the inflation picture. A slower rate increase of 0.50% points in December presents a market-friendly attitude from the Fed.

We believe there could be more upside potential for the stock market during holidays or even Q1 2023. However, prolonged high inflation is going to be back to smash the markets. Combining layoffs and falling housing prices, the stock market will be hit hard again in 2023 for sure.

Therefore, staying alert and keeping eyes open for both risks and opportunities are the best strategy.