January 24, 2023, 8:52 pm EST

A Dull Day

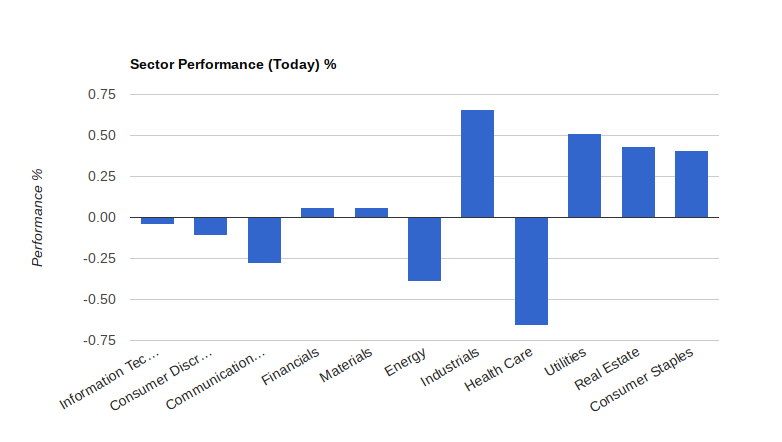

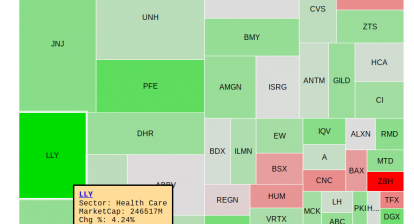

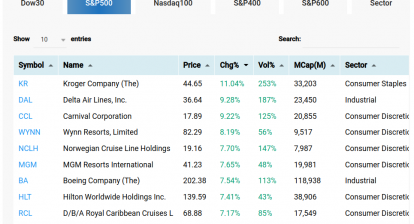

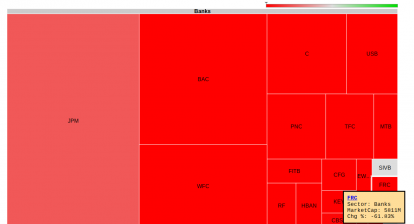

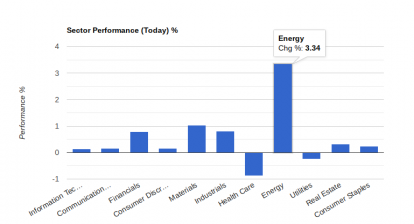

It is a dull day with mixed performance among major indexes. Offensive sectors (left columns) were flat and defensive sectors (right columns) are up which spell out a defensive tone as shown.

S&P 500 (SPY) is still within the circle mentioned in the 01/19 article. So, it means the market is undecided at the congested junction of all trend lines. It is important to be alert in either direction when the stock market picks the way, either by earnings or other news.

We already mentioned both software and hardware lists that we would consider adding to our portfolio when breaking out occurred.

There will be another list to consider when breaking down arrives that we will publish whenever appropriate. The list will focus on defensive names like food, and drinks in the consumer staples sector.

Our viewpoint is that high inflation is going to press down on the economy in 2023. But mild recessions may encourage certain industries to run on their own race. Thus, investment opportunities are available for those who are prudent in picking the right industries and stocks.