August 8, 2021, 3:37 pm EDT

Clean Energy, Infrastructure, and E-Commerce

New emerging leaders could come from three areas: clean energy, infrastructure, and E-Commerce. In this article, we will outline their background and representative stocks for reference.

- Clean Energy: There is no doubt the demand for clean energy is rising quickly with the skyrocketed transitional energy price like gasoline. Furthermore, the auto trend is rapidly shifting to eclectic vehicles worldwide. Solar panels occupy more roofs than ever as people want to get more from the sun rather than paying for the power. Lithium batteries, solar switches, inverters,s and all kinds of clean energy industries could dominate or replace transitional power usage for years to come. Thus, the following stocks are worth attention: SEDG, ALB, ENPH

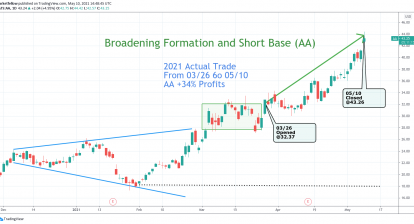

- Infrastructure: US government is working on approving the 1 trillion infrastructure spending. It will benefit material sectors like aluminum, steel, copper, etc. Please check out these stocks: AA, NUE, STLD, MLM

- E-Commerce: E-commerce is already a mature industry in the US like Amazon or eBay. But in other parts of the world, it is still in the early stage of full development. For example, MercadoLibre (MELI) made a strong earning report last week that could be an ideal candidate for the watchlist.

The industry trend is your friend for your investment decision. Above stocks also form uptrend momentum that requires further analysis to find the best entry point.