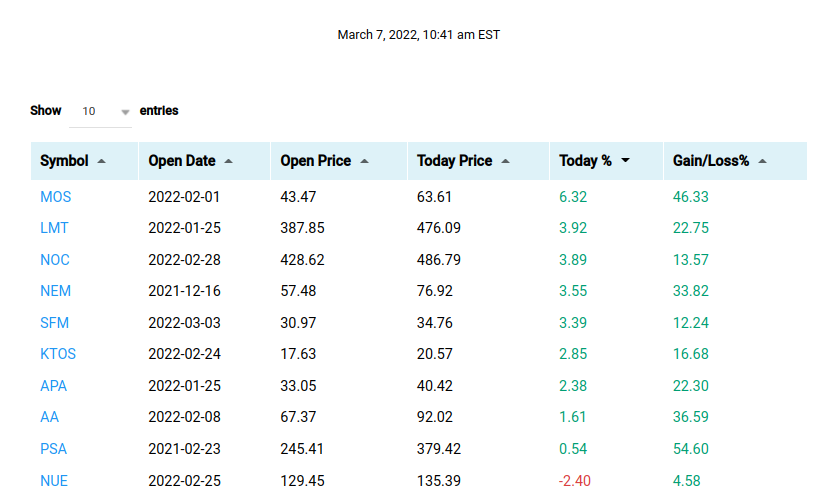

March 7, 2022, 10:41 am EST

Breakdown of the Technology and Rise-up of Defense and Defensive Stocks

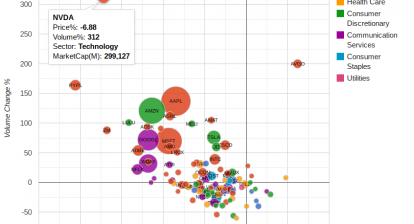

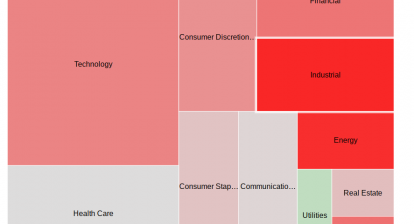

While FB -4% is leading the technology into new local lows, other mega caps follow a similar downward spiral: AAPL, AMZN, GOOGL, TSLA, NVDA. The other picture shows a totally different view where defense (jets, carriers, missile makers) and defensive (food, supermarket, gold, REIT) stocks surge up for 52-week new highs.

There should not be any surprise as we mentioned many times since the beginning of 2022. The Bull-Bear transitions are mentioned in our January series articles (I, II, III). Furthermore, the same technical behavior of the Nasdaq-led down chart is exactly the same as the year 2000 dot-com bubble.

However, it is important to understand that money does not disappear into cash positions because mutual funds are obligated to invest in the stock markets regardless of the market phase. Thus, there are some stocks that would benefit and rise up while the technology is sinking. Although the selections are fewer, new winners are there according to the environment and conditions. Therefore, it is necessary to visualize the background and invest properly in the right type of market.

We displayed our portfolio in the featured picture in order to illustrate our perspectives and actions. Basically, there are four groups of stocks that we think will continue to perform well for wars, inflation, survival, and fixed income.

- Defense: LMT, NOC, KTOS

- Inflation: NEM, NUE, AA, APA

- Survival: MOS, SFM

- Fixed-income: PSA, ZIM

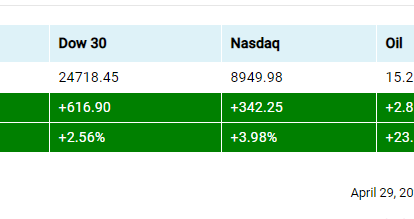

As of now, the stock market is down -400 points in Dow Jones and -1.6% in Nasdaq so the overall picture is looks bearish. It is essential to monitor your portfolio carefully as the new lows of major indexes will open up a major downtrend and powerful selling from the current level. Most stocks cannot survive in this scenario that could wipe out -50%-90% of their values. Protecting your assets by cutting the loss is essential to go through this rough period. Some stocks would rise up if you understand the logic and relationship of money flow and market conditions.