April 29, 2022, 12:36 pm EDT

Coming Bear Market and Recession

“Are we there yet to the bear market and recession?”. “Not Yet” Wiki replied.

- Bear Market: One generally accepted measure of a bear market is a price decline of 20% or more over at least a two-month period (Wiki)

- Recession: it is defined as a negative economic growth for two consecutive quarters (Wiki)

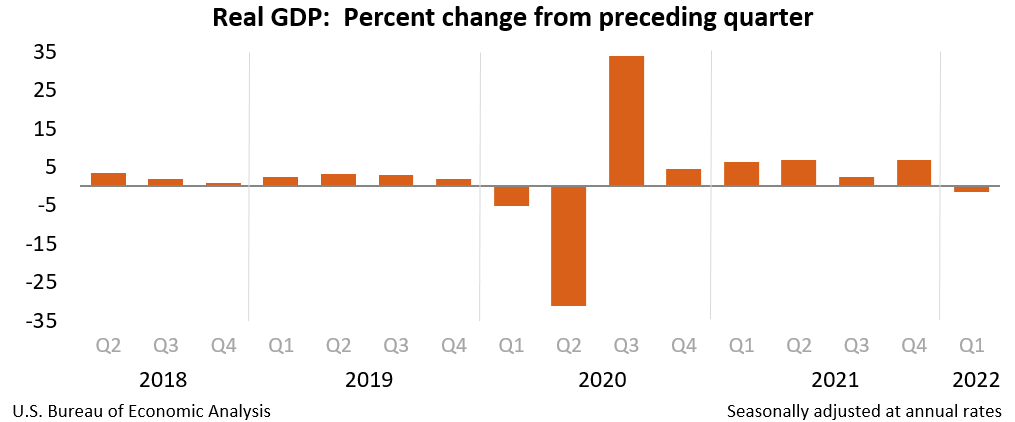

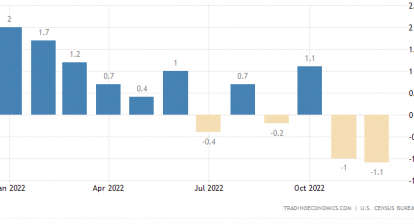

According to the US Burea of Economic Analysis GDP report yesterday. 2022 Q1 GDP dropped to -1.4% as expected +1%. Although the stock market still cheered up with big gains yesterday in echoing strong earnings from Meta Platform Inc (FB) with Nasdaq +3% gains, the excitement faded away quickly as all major indexes appeared in the red color.

Disappointing earnings from Amazon (AMZN) -14% got the blame. But, most investors know that a bear market and recession are on the way.

2022 Q1 covered the US economic data from January to March 2022. It does not fully count the effect of the Russia-Ukraine war with its sanction effects. Also, it does not include the consequence of China’s lockdown in Shanghai for the ripple effect of global economic impact. Thus. these two factors would play major roles in the 200 Q2 GDP which will be announced 3 months later. Our view is that Q2 GDP has a high chance to get deeper into the negative area. Thus, it means the recession will arrive at that time.

Here are our Yeat-To-Date % Change for the major indexes:

- Dow Jones: -8%

- S&P 500: -12%

- Nasdaq: -20%

As we can see that Nasdaq is just about to enter the bear market. Dow Jones and S&P 500 are still a distance away from -20%. So, it does look bearish as well.

In fact, we do not need to wait for the formal announcement of a bear market and recession by definition. There were many signals that already appeared for the coming bears and economic hardship. Knowing is one thing, going through it is another. Record-high inflation loss of income, shortage of food or supplies mixed with emotions of fear and worry are the real pains.

There are many ways to deal with it as mentioned in the “Survival Handbook”. Remember cash is king and saving is the way.

Furthermore, there could be specialized industries to prosper during the economic hardship like the pawnshop we mentioned yesterday.