January 28, 2023, 10:52 am EST

Are Bulls Back?

Are bulls back? This is the subject of this article. Since January 2023 is near the end with two trading days remaining next week, it is important to answer this question so that investment strategy can be set accordingly.

Having five major economic and political factors that hammered the stock market in 2022, we also need to look into them later:

- Inflation

- Rising Rates

- Job Market and Housing Market

- Wars

- COVID-19

First, let’s check out the hard data that consists of investment reactions on the major indexes and popular technology stocks.

Major Indexes Performance

| Index | Year-To-Data (YTD) | 1 Year |

| Dow Jones | +2.5% | -0.5% |

| S&P 500 | +6.0% | -5.9% |

| Nasdaq | +11.0% | -12.9% |

Obviously, all major indexes performed very well with 2% – 11% YTD results. More importantly, Dow Jones almost reached the 52-week high level at -0.5% short. Nasdaq is still far behind with a double-digit loss. But, S&P recovered to less than -6% range.

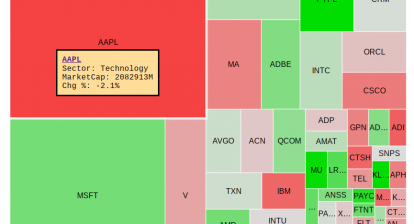

Popular Technology Stocks Performance

| Symbol | TSLA | GOOGL | NVDA | AAPL | AMZN | MSFT |

| YTD | 44% | 12% | 39% | 12% | 21% | 3% |

The popular technology stocks scored very high within a month in 2023. Excluding MSFT single-digit gains, all others obtained 12% to 44% gains.

Therefore, it is difficult to argue from the performance point of view that bulls are not there.

Second,, let’s check out the breadth readings for percentage with respect to their moving average lines.

- Percent of Stocks Above 20-Day Average (MMTW)

- Percent of Stocks Above 50-Day Average(MMFI)

- Percent of Stocks Above 200-Day Average (MMTH)

The following chart shows the Percent of Stocks Above the 200-Day Average (MMTH):

When the majority of stocks (>70%) are above their short-term (20 DMA) and medium-term (50 DMA) and more than half or 57% of them stay above the long-term (200 DMA) line, the overall performance is indeed strong.

Third, the major economic and political background needs to be reviewed. The inflation situation is improving but it remains high (CPI, PPI > 5%). Fed officers present dovish gestures that could mean slowing down the rate hike policy. Having a strong job market and housing markets, Fed’s decision seems to care less about the inflation threat. It is debatable whether the inflation is severe enough for individuals and businesses. Especially, when we hear more about layoff news and bankruptcy announcement.

Two wildcards belong to the wars and COVID-19. Nobody knows what will happen for these two things in 2023 so let’s put them aside until further news.

In summary, the stock markets are boldly optimistic about inflation conditions and Fed’s attitude. Thus, the beaten-down mega technologies rallied suddenly in January 2023. Offensive stocks outperformed defensive stocks that appeared in Nasdaq leading and Dow Jones lagging. Therefore, bulls may have a chance to pick up the upside momentum. Even though inflation could attack consumers and corporations ahead in 2023, bulls are getting the strength for the short-term and medium-term. Investment strategy should gear toward cautious optimism for opportunities.